Four years and billions later, Intel’s Habana Labs is still searching for success amid layoffs

As Intel grapples with layoffs and massive cost-cutting, its high-stakes $2 billion acquisition of Habana Labs in 2019 has struggled to make a dent in Nvidia’s dominance.

Intel’s $2 billion acquisition of Israeli startup Habana Labs in 2019 was expected to mark a new era for the tech giant, positioning it to compete in the highly lucrative artificial intelligence (AI) market. Four years later, however, Intel’s bold ambitions appear tempered, as setbacks, missed revenue targets, and strategic pivots have complicated the company’s path to AI dominance.

Founded in 2016 by David Dahan and Ran Halutz, Habana Labs specialized in developing AI processors optimized for the rising demand in data center applications. Intel’s acquisition represented a bold move to expand beyond its traditional CPU market and to challenge Nvidia’s firm grip on the AI chip sector. With Intel banking on Habana’s Gaudi chips to break Nvidia’s near-monopoly on AI acceleration, the stakes were high.

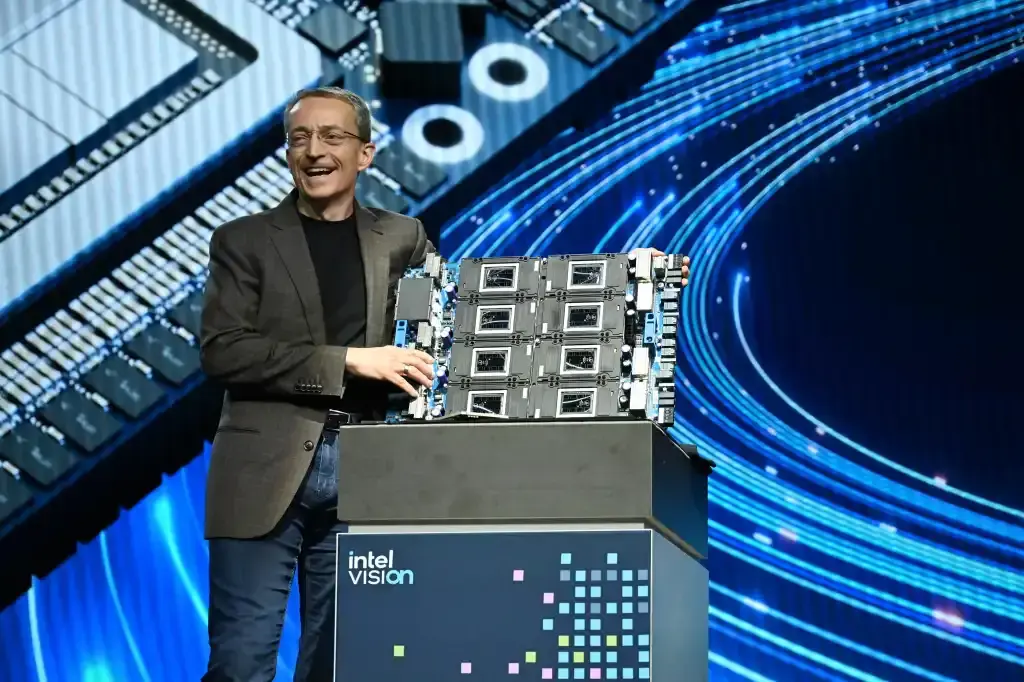

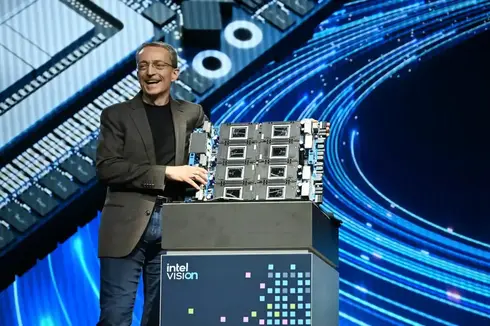

Yet, the anticipated challenge has thus far failed to materialize. Intel released two Gaudi chips post-acquisition, Gaudi 1 and Gaudi 2, aimed at offering data center clients an alternative to Nvidia’s GPUs. But these products have struggled to gain traction in the market. Recently, Intel announced that Habana’s latest product, Gaudi 3, would ultimately merge into Intel’s Falcon Shores project, a combined CPU-GPU platform scheduled for release in 2025. This shift signals a move away from Intel’s original vision of Habana as an independent AI brand, casting further doubt on the future of its roadmap.

Intel’s struggle with Habana Labs has played out against the backdrop of company-wide cost-cutting and workforce reductions. Last week, Intel laid off hundreds of employees across its Israel offices, though it remains unclear how many Habana Labs staff members were affected. Once an independent unit, Habana Labs has since been fully integrated into Intel, and employees who had previously worked under the Habana brand are now part of the broader corporate structure. The absorption of Habana Labs also resulted in the departure of its founders, Dahan and Halutz, who have since launched a new AI venture along with former Habana chairman and serial entrepreneur Avigdor Willenz. With their departure, Intel has lost not only key engineering talent but also valuable institutional knowledge and vision.

Intel’s difficulties meeting revenue projections have highlighted the challenges the company faces in adapting to a rapidly advancing AI market. Originally, Intel aimed to generate $1 billion in annual Gaudi chip sales by 2024. This target was later halved and eventually abandoned due to delays in software integration and supply chain disruptions. An Intel spokesperson acknowledged the difficulty, saying, “No company converts 100% of its pipeline into revenue,” but the shortfall has stoked concerns about Intel’s ability to compete in AI hardware.

In 2022, the company laid off around 100 employees at Habana Labs, about 11% of the division’s workforce, as part of broader cost-cutting efforts across Intel. The move was seen as an attempt to streamline operations amid restructuring, but it also underscored the hurdles Intel has encountered in fully integrating Habana’s technology.

Intel’s AI aspirations now largely hinge on the success of the Falcon Shores project, which is set to integrate Habana’s technology into a hybrid CPU-GPU framework for data centers. This approach aims to bring AI acceleration closer to Intel’s core processing units, potentially creating a distinct niche in the AI market. However, this strategy diverges significantly from Intel’s initial vision for Habana and may not generate the high-margin revenue needed to compete with Nvidia.

The acquisition of Habana Labs was meant to propel Intel into a position to challenge Nvidia’s dominance, but thus far, the results have been limited. With Nvidia and other competitors evolving quickly, Intel’s journey in the AI market remains a difficult one. As the company pushes forward with Falcon Shores, it’s betting that this pivot could help recoup some value from its ambitious $2 billion investment in Habana Labs, even as broader restructuring efforts underscore the scale of Intel’s challenges in the AI race.

Reuters contributed to this report