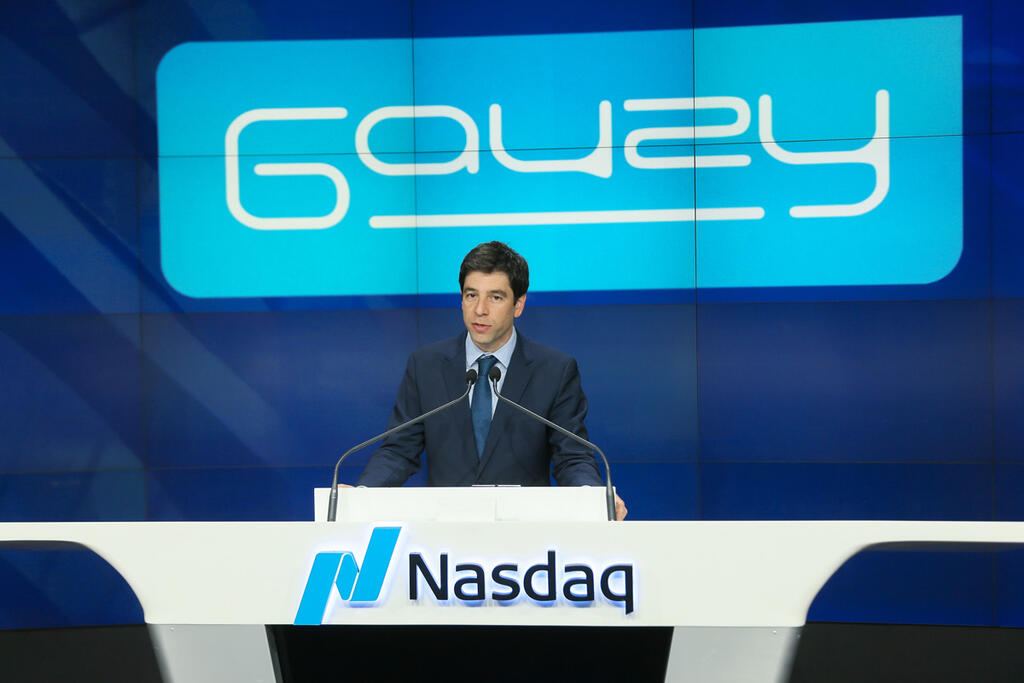

Gauzy settles for underwhelming $244 million valuation in Nasdaq IPO

The nanotech startup was forced to make a significant compromise on its valuation, even though it aimed for a valuation of $500 million, as it only had $4.2 million remaining in its account as of the end of the first quarter

The smart glass company Gauzy raised $75 million in an initial public offering (IPO) of its shares on Nasdaq on Wednesday. The price per share was set at $17, which was at the lower end of the offering's pricing range of $17-19 per share.

The company's valuation at the offering was $244 million before the money and $319 million after the money. Gauzy was forced to make a significant compromise on its valuation, even though it aimed for a valuation of $500 million, because at the end of the first quarter only $4.2 million remained in its coffers. The OIC fund invested $15 million in the offering. The company trades under the symbol GAUZ.

On April 11, Calcalist learned that Gauzy was on its way to an IPO with a target valuation of $500 million. This was after it froze an IPO attempt at the beginning of 2023 due to high interest rates, which dried up IPOs on Wall Street. However, from the beginning of 2024, there has been a certain recovery, although mainly concerning large technology companies.

Gauzy’s prospectus showed that the company's revenues in 2023 were $78 million, a significant jump of 59% compared to 2022 when revenues were $49 million. While the company doubled the gross profit from $9.7 million to $19.9 million in 2023, at the operational level, it is still losing money, with $32 million in losses in 2023, as in 2022. However, the loss in the bottom line in 2023 was significantly greater, standing at $79.3 million compared to $32.9 million in 2022, mainly due to a jump in financing expenses to $47.1 million compared to only $5.5 million in 2022. The EBITDA was also negative in 2023, standing at $20.7 million compared to $20 million in 2022.

Gauzy was founded in 2010 by Eyal Peso, who serves as CEO, Adrian Lofer, who serves as CTO, and Dmitry Dobrenko. The company has developed smart glass, which allows for the control of the shading level of the glass in vehicles or buildings. Among its customers are manufacturers of windshields for vehicles, television manufacturers, and more, including the South Korean corporation LG, which was helped by Gauzy to develop a transparent TV screen. Other clients include car manufacturers BMW, Hyundai - which also invested in the company; Mercedes - which was the first to purchase Gauzy's product; Texas Instruments; and the aircraft manufacturer Airbus.