IL Tech in NY

2LVC: “We are confident and excited for the future of Israeli tech”

The VC joined CTech for its IL Tech in NY series, in collaboration with Israeli Mapped in NY.

“We focus on long-term fundamentals rather than short-term volatility, and historically, Israeli startups have proven to be resilient across multiple economic and geopolitical cycles,” said Two Lanterns Venture Capital (2LVC).

2LVC is an early-stage venture firm investing in pre-seed and seed-stage software startups in the U.S. and Israel. It joined CTech for its IL Tech in NY series, in collaboration with Israeli Mapped in NY.

“Following October 7, we communicated with our companies and offered our support whenever possible…At Two Lanterns, we are confident and excited for the future of Israeli tech.”

You can read the entire interview below.

Fund ID

Name and type of VC: Two Lanterns Venture Capital (2LVC). Venture capital fund investing in early-stage software companies in the US and Israel

Main fields of investment: Generalist Software; Artificial Intelligence; Digital Health; Ecommerce; EdTech; Defense; Data Science; B2B SaaS

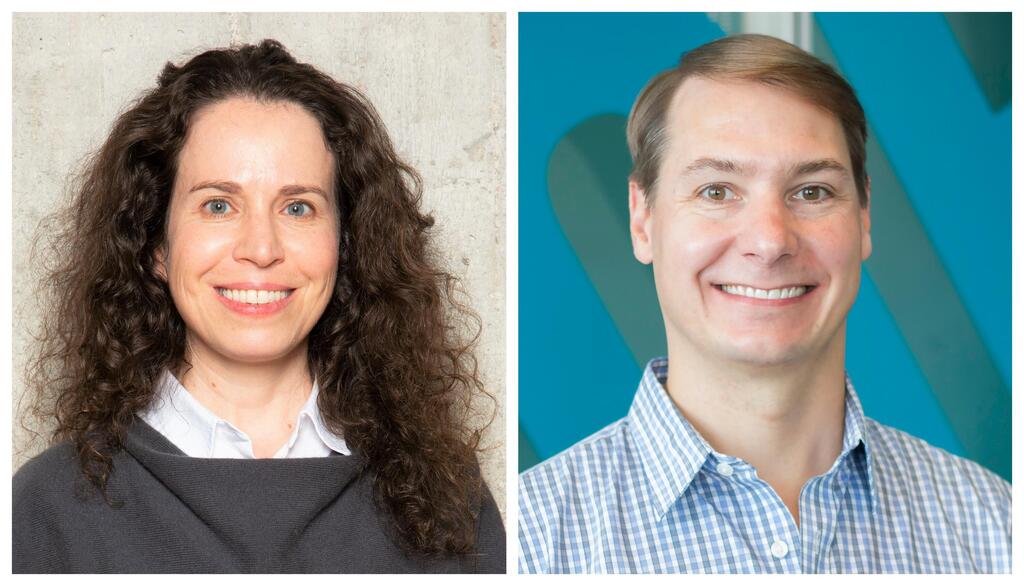

Names of managing partners: John Harthorne, Founder & Managing Director; Michal Gilon-Yanai, Co-Founder and General Partner

Partners and/or other backers: High-net-worth individuals, family offices

Year of founding/start of NY operations: 2020

Total sum of investments/size, number of funds: Fund I: $25.5M; Fund II: Target $30M+

Median investment amount/Average investment in startups: $500K

Number/size of rounds led: None in fund I; open to lead or co-lead in fund II

General background on the organization, its managers, its founders and partners:

Two Lanterns Venture Capital (2LVC) is an early-stage venture firm investing in pre-seed and seed-stage software startups in the U.S. and Israel. 2LVC was co-founded by John Harthorne, who is based in Boston, and Michal Gilon-Yanai, who is based in New York City. They met while studying for their MBA at MIT. John is the former founder and CEO of MassChallenge, the world’s largest startup accelerator where he oversaw the creation of 10 programs globally which graduated over 3,000 startups that generated billions of dollars of revenue.

Michal brings hands-on experience establishing and leading university accelerator programs along with meaningful connections in the Israeli startup ecosystem. She grew up in Israel, served in the IDF Intelligence, studied Computer Science and Law at Tel Aviv University and started her career at iMDsoft, one of Israel’s first digital health startups.

2LVC leverages an extensive network built over many years of working at, supporting, and scaling startups to identify and support high-potential founders.

The VC vision:

2LVC is focused on backing talented teams solving critical problems with scalable, technology-driven solutions. The 2LVC team believes that authenticity, creativity, and collaboration are critical catalysts for advancing the technology innovation that will create a more inspired and prosperous society. Beyond providing capital, they work side-by-side with their portfolio companies to foster growth through proactive support, shared insights, and a strong belief in the importance of integrity and community.

What types of Israeli startups/entrepreneurs are you interested in?

We look for ambitious founders focused on generating revenue and results and can assemble a team with the domain and technical expertise necessary to tackle critical problems in large markets.

Why invest in an Israeli company in New York? What advantages do such companies have? How is the New York market different from the Israeli market?

We are enthusiastic about investing in Israeli companies due to the strength, talent, and resilience of the Israeli tech ecosystem.

For Israeli startups, expanding to New York, either by partnering with a New York-based investor or by having team members in NYC, offers several important benefits, including:

- Proximity to US customers: New York is home to major financial, enterprise software, and consumer F500 companies.

- Access to capital: There are numerous NY-based venture funds and investors who can support a startup’s growth with funding.

- Larger GTM Opportunity: The U.S. is the main target market for most Israeli startup companies, and expanding to New York provides easier access to large partnerships and sales opportunities across the country.

However, there are also some potential downsides to be aware of, such as the high costs of operations and managing remote teams in different time zones.

How do Israeli entrepreneurs/startups differ from their local counterparts?

Israeli entrepreneurs are often highly technical, resilient, and deeply problem-focused. Many come from backgrounds in elite IDF units, a unique experience that prepares them for some of the challenges faced by a startup founder. Those who come from elite intelligence/tech units develop differentiated expertise in extremely technical fields, such as cybersecurity, AI, and data analytics.

Compared to U.S. founders, Israeli entrepreneurs tend to be highly resourceful, often due to experience operating in a more capital-efficient environment. They often follow a ‘tech first’ approach, focusing on optimizing their technology before launching a go-to-market effort. Israeli founders are hard workers, dedicated to meeting their goals, and resilient in the face of adversity.

How do you assess the risk involved in investing in Israeli companies in the current situation?

At Two Lanterns, we are confident and excited for the future of Israeli tech.

We focus on long-term fundamentals rather than short-term volatility, and historically, Israeli startups have proven to be resilient across multiple economic and geopolitical cycles.

Following October 7, we communicated with our companies and offered our support whenever possible. We encouraged our founders to make continuity plans in case key team members were called to serve in reserves. Team risk and talent retention was the largest risk that concerned us, as much of the top technical talent in Israel was impacted by military reserve duty. We also consider supply chain, national security, and regulatory risks for the startups we invest in.

While geopolitical challenges exist, Israel remains one of the world’s top innovation hubs, and many leading global VCs continue investing in Israeli technology. We remain long-term believers in the Israeli ecosystem and plan to continue investing in high-quality companies in Israel. While there have been short-term challenges, we see increased resilience and innovation sparked by the conflict as well, particularly in AI, cybersecurity, and defensetech.

Are there any legal or regulatory considerations that you take into account when investing in Israel?

We remain up to date on Israel’s laws and regulations, and consider any potential impact on startups we are reviewing for a potential investment. However, most of the Israeli companies we invest in either have or are planning to establish a US entity as well, to facilitate their operations.

As a US-based fund, we also consider eligibility of QSBS tax benefits, which are beneficial to venture capital funds and our investors. Most Israeli startups incorporate as Delaware C-corps early on, which reduces friction in this regard.

When evaluating and investing in Israeli companies, we work with both US and Israeli lawyers to ensure that we are aware of any important legal issues, but for the most part there are relatively few regulatory considerations related to investing in Israeli startups.

How do you deal with possible law/regulation changes in Israel?

We have legal advisors who monitor for relevant changes in taxation, securities laws, and foreign investment policies and their potential impact on us or our portfolio companies.

Are there global trends that influence your decisions to invest in Israeli high-tech?

Our decision to invest in Israel is largely independent of global trends; however, there are several trends that impact our allocation and areas of interest within the Israeli tech ecosystem. One macro trend shaping our investment thesis is Israel’s edge in AI. The rise of generative AI is creating new opportunities in enterprise software, cybersecurity, and data infrastructure, areas in which Israel is particularly strong.

The current increase in global instability is also generating more interest in defense technologies, and the challenges that Israel has faced in the past couple of years and continues to face have provided deeper insight into developing new solutions. This is another area that is clearly a strength of the Israeli ecosystem.

We are in the midst of the AI revolution. Do Israeli companies have an advantage in this sector, or is there actually room for improvements?

Yes, we believe that Israel has a strong AI advantage. Expertise from top IDF tech units translates well into AI applications in areas such as security, data infrastructure, DevOps, and predictive analytics. This fosters an experienced and inventive community of technical talent and gives rise to new, innovative companies. Moreover, the strength of Israel’s academic institutions deepens this knowledge and often enables companies founded in Israel to maintain a competitive edge.

In terms of areas for improvement, Israel does exceptionally well in AI research and technical development, but there is still room to strengthen AI commercialization, scaling, and global distribution. Israeli AI founders at times face competition from well-funded Silicon Valley competitors in AI, where access to capital and large-scale datasets can give U.S. startups advantages.

Ultimately, we believe that Israel is poised to be a top hub for the AI revolution as long as it continues to invest in excellent training and education.

Two suggestions for Israeli entrepreneurs on what to do in New York:

- Learn and be aware of the cultural differences. It will help both in terms of how you behave with potential customers and investors, and in interpreting the behavior of others. For example, Americans are typically less direct than Israelis, and if they say your company and product are very interesting, it doesn’t necessarily mean that they are going to buy or invest.

- Find a way to get connected to at least one friendly Israeli founder and one friendly Israeli investor before you get here. It will help to secure valuable feedback from them and will significantly shorten the path to meet more people in NYC, both within and outside of the Israeli community.

Two suggestions for Israeli entrepreneurs on what not to do in New York:

- Don’t come to meetings unprepared. Target the right people and reach out through a warm contact. Also, first impressions matter – make sure there are no spelling/grammar mistakes in your deck and remember when meeting people that in the U.S, it’s a more traditional professional environment.

- Don’t underestimate the time it takes to schedule meetings and run a diligence process, as this tends to take longer in the U.S. than in Israel. Also, be aware of the typical VC calendar here and which times of the year to avoid fundraising (e.g., the middle of the summer, Thanksgiving through Christmas time).

Examples of 2-3 of your most successful investments:

2LVC has several excellent investments in Israel. Following are a few in which AI is core to the technology and product:

Loora

Loora has developed the most advanced AI English tutor on the market, building a bespoke system of cutting-edge large language models, specifically trained and optimized to provide the best and most personalized experience for each learner. The Loora AI tutor is always available and 10x more affordable than a human tutor.

Founders are Roy Mor and Yonti Levin. Co-investors include QPV, Emerge Ventures, Kaedan Capital and top-tier Angels including Zohar and Amit Gilon.

Botika

Botika stands as the AI Creative Director for over 5 million small apparel businesses, powered by proprietary simulative AI models. With Botika at the helm, business owners can devote their attention to the heart of their operations while the platform adeptly oversees every aspect of visual content creation, deployment, and ongoing optimization - resulting in significant revenue increases across key business channels.

Founders are Eran Dagan and Yarin Didi Meir. Co-investors include Stardom Ventures and top tier angels.

Linguana

Linguana enables content creators to expand the global reach of their videos with a fully managed localization solution. Utilizing AI, Linguana partners with creators to launch their content across languages and platforms to reach new audiences for additional monetization opportunities.

Founders are Yuval Tal, founder of Payoneer (PAYO) and Borderfree, and Oded Shafran, former CTO of IMGN Media.