CyberArk’s surge, Wiz and Cato prepare for IPOs: Israeli cyber firms ready for the next big move

As the cybersecurity market evolves, Israeli firms are ramping up competition with Palo Alto Networks, with major IPOs on the horizon.

If anyone needed a definitive stamp of approval that Israel is a cyber power, it happened last weekend: the three largest Israeli companies, or those with ties to Israel, in terms of market value are cyber companies. In other words, these are not just valuations written on ice in the private market. This shift occurred after CyberArk, which had been a rather sleepy company in recent years, overtook Teva and reached a value of $20 billion. Now, the top Israeli companies by market value are as follows: Israeli-founded Palo Alto Networks, with a market value of $131 billion; Check Point, now trading at $24 billion; and CyberArk, with Teva and Bank Leumi trailing behind at around $19 billion each.

One can, of course, debate to what extent Palo Alto—founded by Nir Zuk but registered in the U.S. and managed by American CEO Nikesh Arora—is truly an Israeli company, or what significance this ranking at a specific moment in time really holds. But one thing is very clear: the cyber market has not yet said its last word. Private companies like Wiz, which last raised funds at a $12 billion valuation and later rejected a $23 billion acquisition offer from Google, are heating up on the sidelines, seemingly aiming for an IPO valued at more than $20 billion. The company recently hired a CFO for the first time, signaling that Assaf Rappaport and his co-founders want to go public soon, possibly in 2026.

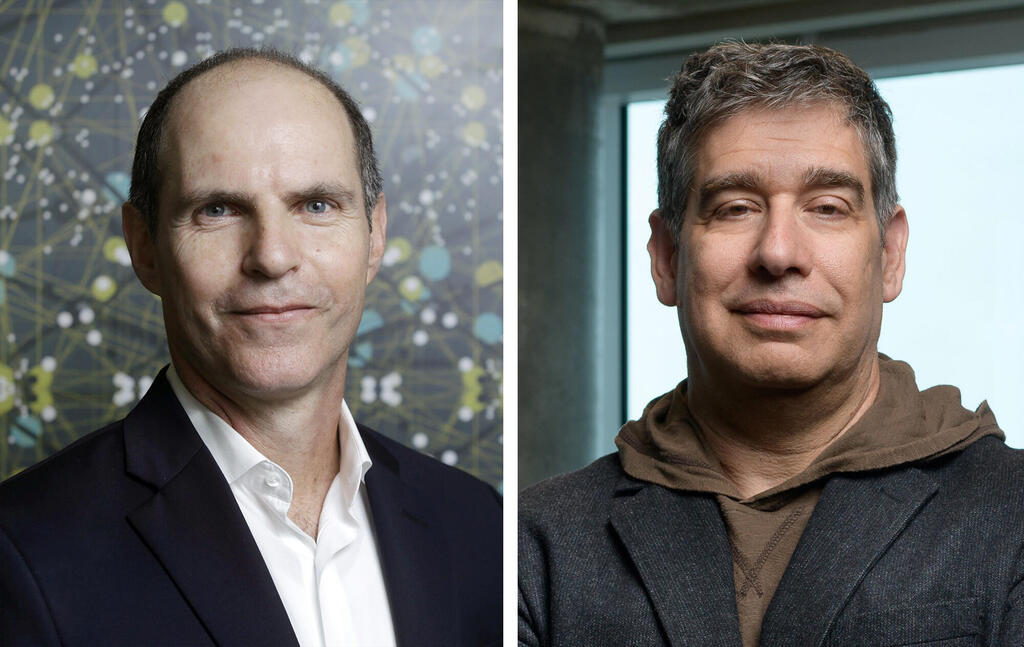

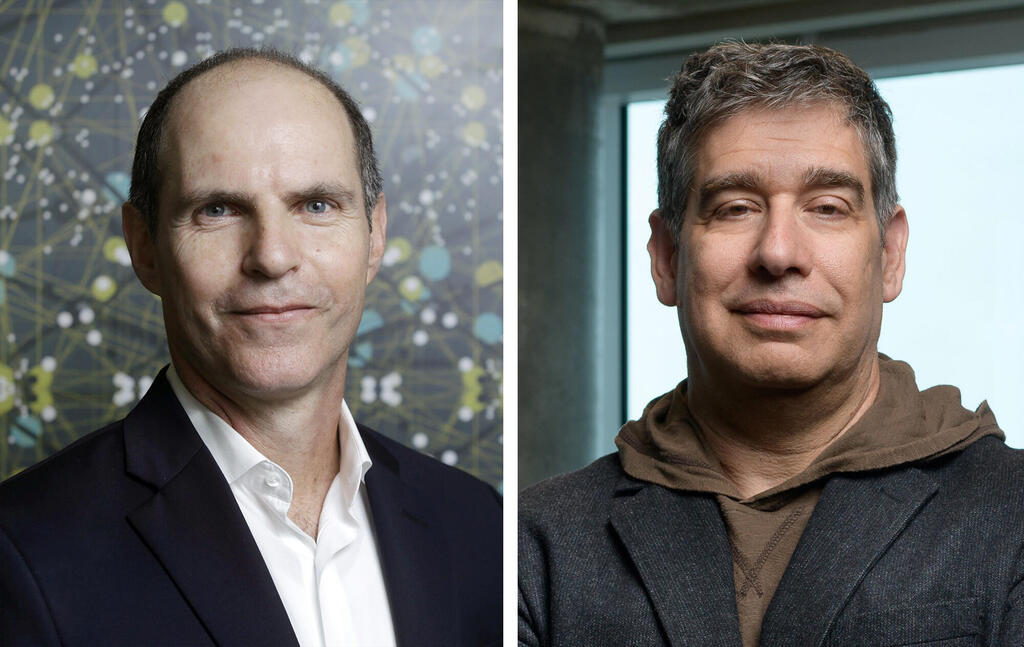

2 View gallery

CyberArk Executive Chairman Udi Mokady and Palo Alto founder Nir Zuk.

(Photos: Yonatan Bloom and Amit Shaal)

In 2025, Shlomo Kramer's Cato Networks is also set to join the Israeli public cyber club. The company recently strengthened its board of directors with the appointment of Eyal Waldman, founder of Mellanox, and Gili Iohan, who was CFO of another Israeli public cyber company—Varonis, which currently trades at $4.9 billion. Kramer, one of Check Point's founders, is targeting an IPO at over $3 billion. Meanwhile, Snyk, last valued at $7.4 billion, has been working on an IPO prospectus for a year and could go public as soon as 2025.

Until recently, IPO talk was mostly wishful thinking. However, something significant happened last weekend—the IPO of the American company SailPoint, which debuted at a $13 billion valuation. SailPoint competes directly with CyberArk in the identity management market for enterprises, and CyberArk owes at least part of its 20% stock surge last month to SailPoint’s successful roadshow. Following the roadshow, SailPoint raised its IPO share price and increased its fundraising to $1.4 billion, with underwriters reporting a 20-fold oversubscription. The stock began trading on Thursday, and although it did not achieve the double-digit surge—known as a "pop"—that characterizes the most successful IPOs, it still demonstrated investors’ renewed appetite for tech stocks, particularly in cyber.

SailPoint’s IPO was not a trivial event. It is not a hot, fast-growing startup but rather a relatively mature company founded in 2005, which went public in 2017 at a $1 billion valuation before being taken private by the investment firm Thoma Bravo in 2022 for $6.9 billion. The fact that Thoma Bravo managed to re-list SailPoint at nearly double its previous value within just three years is good news for Kramer, who previously sold Imperva to Thoma Bravo for $2.2 billion, and also for Snyk. Wiz will likely succeed regardless of market conditions.

SailPoint’s IPO is also a crucial event for anyone waiting for the IPO window to reopen on Wall Street, in cyber or more broadly, including Israeli companies. In fact, the last significant cyber IPO was in September 2021, when ForgeRock raised $275 million at a $2 billion valuation. That same year, Israel’s SentinelOne went public in the largest-ever cyber IPO at $9 billion but currently trades below its IPO price at $7.9 billion. Meanwhile, in 2024, the American company Rubrik, which is currently valued at $14 billion but primarily operates in backup and data protection, went public at $5.6 billion.

While the cyber sector as a whole is thriving, tensions are brewing internally, making the past week particularly interesting in the Israeli cyber ecosystem. The SailPoint IPO and CyberArk’s strong earnings report, coupled with an optimistic forecast and the $165 million acquisition of an American startup, highlight the growing potential of the identity management sector. CyberArk’s acquisition completes a platform-building effort it has pursued in recent years, adding an authorization management solution for enterprises. In mid-2024, CyberArk made a bold move with the $1.5 billion acquisition of U.S.-based Venafi, aiming to enter the market for managing non-human identities within organizations. In doing so, CyberArk is following the platform strategy that Palo Alto has been implementing since mid-2023, albeit in the one cyber niche where Palo Alto has yet to dominate. Palo Alto has long pursued an aggressive expansion strategy, entering nearly every cyber niche—except identity management.

Five years ago, when Zuk made this decision, identity management was seen as the less exciting segment of cybersecurity, more aligned with traditional IT. However, attackers have since recognized its significance, as many of the most high-profile breaches in recent years have involved impersonation of employees and exploitation of internal system vulnerabilities. Statistics show that even organizations with top-tier perimeter and cloud security often fall victim to breaches due to employees inadvertently granting attackers access via phishing emails. Today, Palo Alto’s decision to avoid identity management seems questionable, as evidenced by investor enthusiasm that has allowed CyberArk to double its value within a year, trading at the highest revenue multiple among Israeli cyber firms.

Still, the hottest cybersecurity segment remains cloud security, and last week saw significant developments in the Palo Alto-Wiz-Check Point dynamic. Palo Alto frequently claims that Check Point is no longer a real competitor, yet Check Point still serves 100,000 customers—including many of the world’s largest organizations—and posted $2.5 billion in revenue in 2024. What Check Point did miss, however, was the cloud security market. Last week, for the first time, Check Point implicitly acknowledged this by announcing a strategic partnership with Wiz. As part of this collaboration, Check Point will discontinue its CNAPP (Cloud-Native Application Protection Platform) product—originally based on its 2018 acquisition of Israeli startup Dome9 for $150 million—and will instead offer Wiz’s solution. If executed effectively, this partnership could be a game-changer for Check Point, provided it is not just an attempt to appease investors. Currently, Check Point is valued at the lowest revenue and profit multiples among its peers, despite being the most profitable, largely due to its failure in the cloud security space.

Wiz, despite its meteoric rise, remains a single-product company in a market that is shifting toward comprehensive security platforms. Partnering with Check Point allows both companies to compete against Palo Alto’s expansive platform strategy. If successful, this partnership could significantly benefit both firms. While such collaborations often lead to mergers, it is unlikely that Wiz, which turned down Google, would accept an acquisition offer from Check Point.

Yet, above all the industry rivalries looms the impact of artificial intelligence. The rise of generative AI is disrupting cybersecurity in multiple ways. Attackers are leveraging AI to conduct more sophisticated attacks, while enterprises are becoming increasingly vulnerable through AI-powered interfaces like customer-facing chatbots. At the same time, AI is also providing cybersecurity companies with powerful new defense tools.

The traditional cybersecurity market is growing, but not at a pace that fully justifies the soaring valuations of its top players. The combined market capitalization of leading cybersecurity firms far exceeds the total estimated market size, which was approximately $250 billion in sales last year and is projected to double by 2030 with a 10% annual growth rate. The past few years have seen heightened demand for cybersecurity solutions due to the shift to cloud computing, state-sponsored attacks, and regulatory pressures. However, Palo Alto’s recent "platformization" strategy—offering certain cybersecurity solutions for free—suggests an increasingly competitive and price-sensitive market. AI may dramatically reshape the landscape, ushering in new players and valuation models that could dwarf even the cloud revolution. While concerns persist about whether Israel has missed the AI wave, the country appears well positioned at the intersection of cybersecurity and AI, with a growing number of startups, major announcements from Palo Alto, and Check Point’s recent initiative to establish a dedicated AI center to ensure it remains a major player in the next technological shift.