Lusix faces collapse after EDP backs out of takeover offer over Israel war risk

The debt-ridden diamond company is looking for alternative bidders after the Japanese investor pulled out.

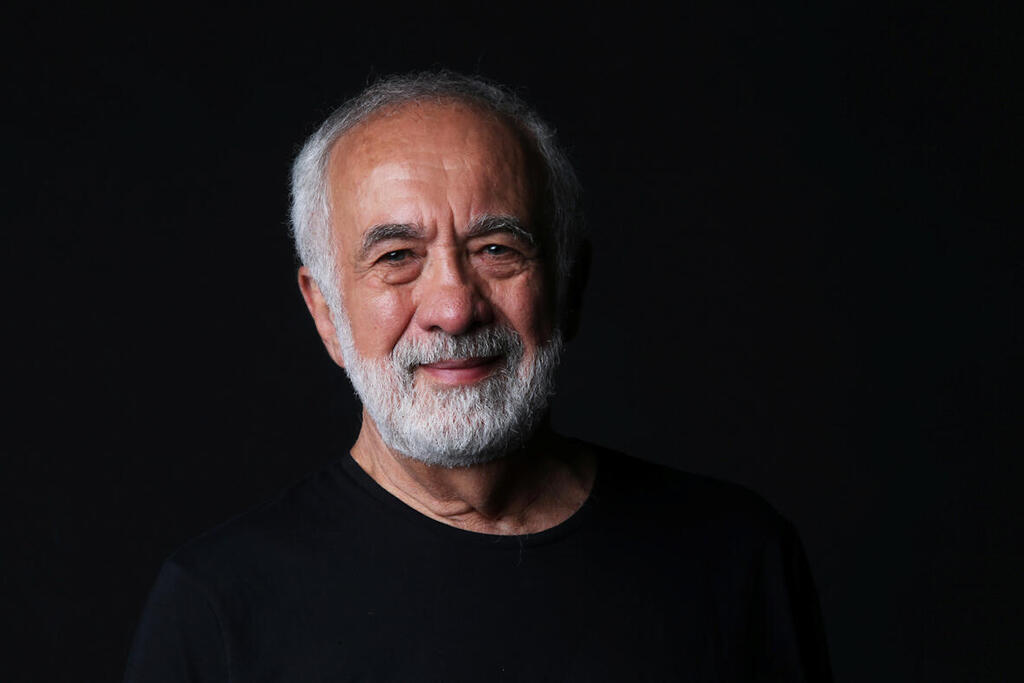

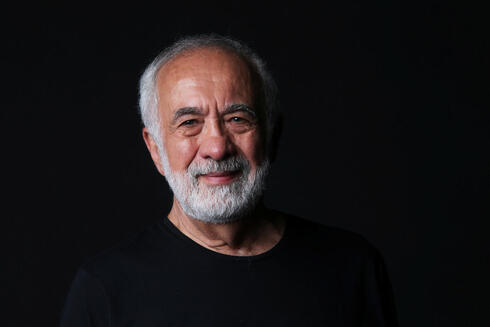

Japanese company EDP has officially withdrawn from its planned acquisition of Lucix, a laboratory diamond producer facing financial distress due to debts amounting to NIS 103 million (approximately $27 million). Calcalist has learned that Naoji Fujimori, the controlling owner of EDP, informed Benny Landa, the founder of Lusix, on Sunday that the board of directors of the publicly traded company decided to withdraw from the deal due to the ongoing war in Israel.

“The board decided not to invest in a country at war. EDP is owned by a large number of small investors and is traded on the Tokyo Stock Exchange. Currently, public opinion in Japan considers investing in Israel too risky. I’m sorry,” Fujimori wrote in a message to Landa, which was then shared with Lusix’s other shareholders and court-appointed officials involved in the company’s insolvency proceedings, which began in August.

EDP had made the highest bid for Lusix during the court-supervised process led by trustee attorney Shay Bar Nir. The Japanese company offered $2.5 million for Lusix. Since its founding in 2016, Lusix has raised $152.5 million from a high-profile list of investors, including Landa, who invested $25 million, Louis Vuitton, More Investment House, Ragnar, and others. EDP proposed paying the $2.5 million in 36 installments and agreed to retain 20 of Lusix’s 50 employees.

With EDP’s withdrawal, the Belgian diamond company Phoenix, whose bid was the second highest at $2.3 million, could reenter the process. Phoenix had recently increased its offer to $2.7 million after EDP failed to provide a 10% guarantee of its bid, even after a second request from Bar Nir. Phoenix has committed to retaining 13 employees if their bid is accepted. Bar Nir has asked the court to extend the stay of proceedings, which was initially set to expire today.

Lusix’s financial troubles stem from its inability to repay its NIS 103 million debt, exacerbated by mounting losses. In 2021, the company reported a profit of $551,000, but by 2022, it had shifted to a loss of $22.8 million. This loss deepened further in 2023, reaching $30.7 million. The first half of this year ended with an additional $11.5 million in losses.