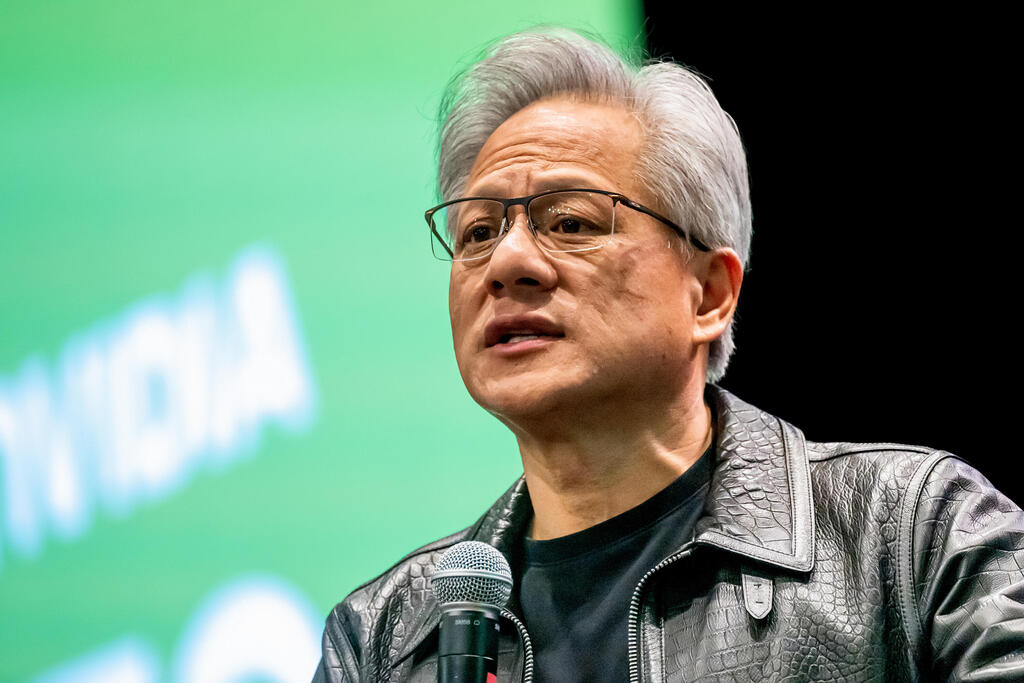

Jensen Huang on Intel buyout rumors: "There might be a party, but I wasn’t invited"

Nvidia’s CEO distances the company from acquisition speculation and reassures investors on AI chip demand.

Nvidia is not involved in any efforts to acquire Intel's manufacturing operations, said the company's founder and CEO, Jensen Huang, in response to a question from Calcalist. "Nobody's invited us to a consortium. Nobody invited me. Maybe other people are involved, but I don't know. There might be a party. I wasn't invited," Huang remarked during a Q&A session with journalists on Wednesday at the company’s annual developer conference.

Last week, Reuters reported that Taiwanese chipmaker TSMC was in talks with Nvidia, as well as AMD and Broadcom, to establish a joint venture that would acquire control of Intel’s chip manufacturing operations. These discussions come amid Intel’s ongoing difficulties and the existential crisis it currently faces.

In response to Calcalist's question on the matter, Huang denied reports that Nvidia is involved in the talks.

Huang also addressed the AI chip export restrictions imposed by the Biden administration in its final days. These restrictions categorize countries into three tiers. The first tier, which includes the United States and 17 other countries—such as Belgium, Canada, Australia, Denmark, France, Germany, and the United Kingdom—faces no export restrictions. Tier 3, which consists of the 25 countries under a U.S. arms embargo, including China, Russia, Iran, and North Korea, is completely barred from receiving AI processors. Israel, along with 150 other countries such as Poland, Mexico, Singapore, and the United Arab Emirates, falls into the second tier, where AI chip exports are allowed but restricted to a certain level of computing power.

“In the long run, I believe artificial intelligence is a technology that every country, every industry, and every company needs,” Huang said when asked about the restrictions. “AI is already mainstream. We talk about AI as if it’s some magical technology, but it’s just software. Every country will have the ability to run software. If possible, we would be happy to support every country with American technology and standards. It’s good for countries to have access to the computing power they need, and it’s good for the U.S. too.”

Earlier in the day during a question-and-answer session with financial analysts, Huang said orders for some 3.6 million of Nvidia's flagship Blackwell chips from four top cloud service providers "under represented" demand, since they did not include orders from key customer Meta Platforms and smaller cloud providers and startups.

Facebook-owner Meta is among the largest buyers of Nvidia chips and Mark Zuckerberg, CEO of the social media giant, said early last year the company planned to use Blackwell chips to train the company's open-source large language Llama models.

Meta has said it expects to spend up to $65 billion in AI infrastructure this year, a large chunk of which is expected to go toward Nvidia chips, mirroring similar commitments from other big tech giants as they race to develop the best AI products.

Huang has been trying to allay investor concerns surrounding demand for the pricey AI chips that have made Nvidia one of the world's most valuable firms, after China's DeepSeek made a competitive chatbot with allegedly fewer AI chips.

"The good news is that the understanding of R1 was completely wrong," Huang said on Wednesday, referring to DeepSeek's AI model.

DeepSeek's focus on reasoning - the ability of an AI system to make inferences - will increase the need for computation, helping drive demand for Nvidia chips, Huang said.

Nvidia's shares were up nearly 2% after the analyst call. They fell 3.4% on Tuesday, when investors were unconvinced by Huang's pitch that the company was well-positioned to respond to a pivot in the AI market as businesses shift from training AI models to getting detailed answers from them.

In response to an analyst's questions on the impact of higher tariffs under Trump, Huang said Nvidia sees little short-term impact but would move production to the United States in the longer term.

He gave no timeline.

TSMC, the world's biggest contract maker of chips, has said it plans to make a fresh $100 billion investment in the U.S. that involves building five additional chip facilities.

"We're in it," Huang said, referring to TSMC's new chip fabrication facility in Arizona. "We are now running production silicon in Arizona."

Reuters contributed to this report.