Finance Ministry weighs leverage funds to offset judicial overhaul hit on high-tech

Following the judicial overhaul's severe impact on the high-tech sector, Israel’s Ministry of Finance is considering the creation of leveraged funds, a tool that was employed during the severe crisis of 2008

Despite the outwardly optimistic statements, is the Ministry of Finance actually concerned about the state of the Israeli high-tech industry? Calcalist has learned that some of the Treasury’s senior executives have been conducting meetings with Israeli high-tech leaders in recent weeks to assess the feasibility of establishing leveraged funds, a tool that was employed during the severe crisis of 2008.

During these meetings, the Treasury was represented by Kfir Battat, Deputy Director of the Budget Department at Israel's Ministry of Finance, and Gil Cohen, Senior Deputy Accountant General, Head of Debt, Finance and Credit Division, at the Ministry. This is a follow-up idea to an initiative from a few months ago by Prime Minister Benjamin Netanyahu, who dispatched his close associate and Likud member Shlomi Fogel, along with Dovi Frances, the head of the venture capital fund Group 11, to raise funds from institutional bodies. The two attempted to secure billions of dollars from institutions for a dedicated fund aimed at AI investments to be managed by local venture capitalists.

The very idea reflects the level of concern among the Treasury’s heads, as leveraged funds surfaced globally during the severe crisis in 2008 when there were genuine fears about the stability of the financial system. Leveraged funds are designed to support distressed sectors through funds from institutional bodies, with the state providing certain protections for investments. In the 2008 version, amid the financial crisis, the goal of leveraged funds was to acquire bonds of Israeli companies trading at high yields to prevent a wave of collapses and debt settlements. These leveraged funds were overseen by groups of businessmen specifically established for this purpose, with the Treasury contributing 25% of the capital for investments, while funds belonging to savers deposited in institutional bodies constituted 74% of the invested capital. The remaining 1% came from partners in the dedicated funds.

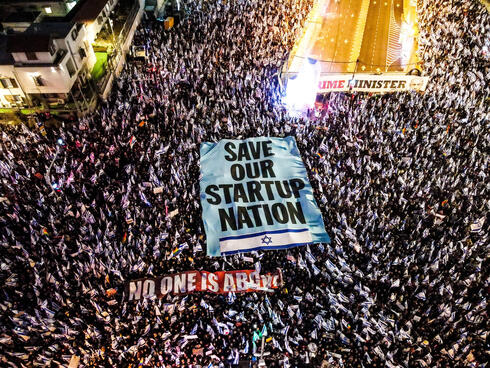

Now, as data revealing the extent of the crisis in Israeli high-tech is clear, the Treasury aims to tap into the funds of pension savers, provident funds, and others to help the industry. Recent data fromStart-Up Nation Central (SNC) indicated a 70% drop in investments in Israeli startup companies during the first half of 2023 compared to the corresponding period in 2022. While 2021 marked a record year for high-tech investments in Israel, with venture capital funds injecting no less than $25 billion into startups, 2022 saw a decline to $16 billion. The current pace, based on the first half of 2023, is now below $10 billion. This rate of investment is the lowest since 2018 and contrasts with signs of recovery in U.S. startup investments recorded between the latter half of 2022 and the first half of the current year.

In addition to the decrease in investment volumes, there was also a 53% decrease in the number of investment rounds compared to the corresponding half, reaching a nine-year low. However, foreign investors dominate the remaining activity, leading 70% more rounds than local investors and making new investments at a volume 17% greater than local funds.

The high-tech crisis can be attributed to two primary factors: foreign investors, responsible for 90% of the industry's funding, have significantly curtailed their activity in Israel due to the judicial overhaul and the drastic shift in the macroeconomic landscape, diverting them from high-tech into less risky avenues. Simultaneously, local venture capital funds, eager to invest in Israeli companies, struggle to raise funds, exacerbating the decline in investments.

The grim outlook from this sector, which accounts for half of exports and nearly a fifth of GDP, appears to have penetrated the professional leaders at the Treasury. Their proposed solution, as usual, involves public savings, despite the less successful history of connecting these two. The institutional bodies, managing over NIS 2 trillion (approximately $540 billion) of savings from the public, aren't enthusiastic about investing in high-tech. They are reluctant to invest directly in high-tech companies due to the high risk associated with them and the fact that even good returns don't significantly impact their bottom line.

Within the high-tech industry, among venture capital funds, accountants and lawyers, the idea of high-tech leverage funds faces disapproval, particularly given the notably unsuccessful experience of leverage funds following the 2008 crisis. Ultimately, the primary beneficiaries of the leverage funds project were the managers of the three funds established under this framework, which collected management fees totaling around NIS 130 million ($35 million) in just three years. These three funds together raised NIS 4.5 billion ($1.22 billion) from institutions, with the state contributing a little more than NIS 1 billion ($270 million).

Though the plan's intention was noble, the bureaucratic processes surrounding its creation were time-consuming. By the time everything was in place, including entity selection through a tender process and organizational efforts, the debt market had already begun to recover from the downturn it experienced in September 2008. Consequently, the leveraged funds weren't truly necessary, as institutions were focusing more on direct investments in promising companies, while leveraged funds directed their raised funds towards less promising ventures. This remains a key risk with the new iteration of high-tech leverage funds: successful companies have little trouble securing capital or debt today. As such, there's a high probability that leveraged funds, fueled by savers' funds, could be allocated to companies without a viable business model or a sufficiently large market.

A potentially more suitable solution could involve encouraging institutional bodies to invest directly in Israeli venture capital funds, which currently struggle to secure investments from foreign institutions. The state could establish a baseline to mitigate negative returns and participate in the high management fees charged by these funds, enhancing their investment appeal.

Startup companies themselves often struggle to manage institutional entities on their shareholder list, entities necessitated by stringent regulations. These institutional entities operate differently from venture capital funds or private investment funds fueled by wealthy qualified investors rather than ordinary individuals.

In recent years, institutions discovered high-tech due to the implementation of benefit track 43 by the Israeli Innovation Authority, where the state guaranteed a baseline investment. The program allocated NIS 2 billion ($540 million) for institutional investments in startups, offering partial loss protection. Though the invested funds came from the institutions, after seven years, there's a review with the state covering up to 40% of losses if returns are negative or receiving a 10% success fee if returns surpass 18.5%. Following this program and against the backdrop of the unprecedented high-tech boom, institutional investments surged from a mere $157 million in 2020 to over $1 billion in 2021. Last year saw a decline to half a billion dollars, still a historically substantial amount. However, the program wasn't renewed, despite the belief in the high-tech industry that another round would be beneficial.

Ultimately, the key question revolves around how extensively pension savings should participate in early-stage technology company financing. Despite the growth of institutional investments in high-tech and criticism of their absence in major exits, these investments carry significant risk requiring specialized knowledge. Not all institutional managers participated in track 43, as their mandate is primarily to maximize returns for savers, rather than encouraging local high-tech.

In a time when government actions, rather than global crises, are largely responsible for industry setbacks, a logical and straightforward solution is to minimize internal risk rather than constructing complex remedies. The Ministry of Finance declined to comment.