Bill Ackman sees 80% return on Tel Aviv Stock Exchange investment in just 10 months

The impressive return reflects a broader trend, as the stock exchange demonstrates resilience despite local economic turmoil.

The stock exchange presents itself as a "meeting place for Israeli companies operating in the economy and the general public," offering the investing public a partnership in these companies, a share in the economy's activities, and the possibility of profiting from their operations.

The stock exchange operates a knowledge center on its website to educate the public about the opportunities and benefits of investing in it, and it seems to be working. Since it began trading in August 2019, its investors have enjoyed a return of 511% and dividends totaling NIS 323 million (approximately $86 million), with its market value growing from NIS 915 million ($243M) to NIS 3.4 billion ($904M).

At the end of 2023, the stock exchange reached an agreement with the banks that held 18% of its shares (led by Hapoalim, Mizrahi Tefahot, and the First International Bank, which together held just under 15%). As a result, in early 2024, after distributing a NIS 231 million ($61M) dividend, the banks sold their holdings for NIS 353 million ($94M), mainly to foreign investors, but also to Israeli institutions such as Migdal Insurance, Harel Insurance, Clal Insurance, and the Noked hedge fund. NIS 111 million of the sale proceeds were transferred to the banks, and NIS 242 million went to the stock exchange for infrastructure investments in technology.

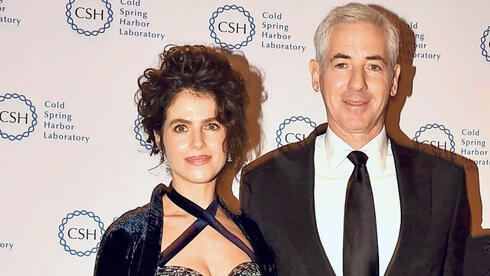

Among the foreign investors was billionaire Bill Ackman, founder and manager of the hedge fund Pershing Square, which manages around $18 billion. Ackman purchased 4.9% of the stock exchange’s shares with his Israeli wife Neri Oxman, stating, "We wanted to buy more, but that's all that was available for sale." In the 10 months since the share sale was announced, Ackman has already registered an 80% return. Alongside public shareholders, the major stockholders today include the Australian-American investment fund Manikay Partners (20%), the Danish fund Novo Nordisk (8.5%), and American Artisan Partners (5%).

Beyond the overall results since its IPO, the stock performed well even in challenging years. In 2023, when the local stock indices showed weakness both compared to previous years and to global counterparts, and in 2024, when the war weighed heavily on the economy and traded companies, the stock exchange’s performance still outpaced many others. While the TA-Insurance and Financial Services Index and the TA-125 Index (the exchange's representative index) rose by 16% and 12%, respectively, in 2023, the stock exchange's share price climbed by 44%.

In 2024, as the Tel Aviv Insurance and Financial Services Index rose by 22% and the TA-125 rose by only 11%, the stock exchange's share price surged by 97%, becoming the third-best-performing stock on the TA-125 Index. Only Electreon and El Al stocks performed better, with increases of 148% and 113%, respectively. Shufersal matched the stock exchange’s performance with a 97% increase.

Along with investors, the stock exchange’s employees have also benefited from the company’s success. In 2023, CEO Ittai Ben Zeev, who took office in early 2017 after leaving his role as head of the capital market division at Bank Leumi, earned a total of NIS 6.2 million. Since his appointment, his total compensation has reached NIS 30 million. In 2024, his annual salary will amount to NIS 2.9 million (gross), along with an annual bonus of up to six months' salary. During 2023, he also received a five-year retention loan, which will be converted into a grant if he remains in his position through the period.

In 2019, Ben Zeev was granted 4.25 million options with an exercise price of NIS 12 per option, all of which vested in one installment last July. With the current share price at NIS 37, Ben Zeev stands to make a profit of NIS 120 million from exercising these options. In 2023, he received an additional 544,000 options, worth NIS 1.5 million, set to vest in full five years from their grant date.

In 2023, the combined salaries of Ben Zeev’s four vice presidents totaled NIS 9.2 million (around NIS 2.3 million each), marking a 50% increase compared to 2022, largely due to options grants. The salary of Eugene Kandel, the stock exchange’s chairman, who holds a 50% position and took office last July, stands at NIS 1.55 million annually.

Alon Glazer, VP Research at Leader Capital Markets, attributes the rise in the stock exchange’s value to the fact that "they are meeting their plans and showing improvement in revenue and profits. The past year proves what the stock exchange has claimed all along – that it is one of the least risky stocks in the market. Simply because it operates continuously. Trading goes on, and the exchange benefits from commissions, making it less affected by economic volatility and able to deliver strong results even in tough conditions."

Glazer also noted that the sale of bank shares at the start of the year improved the stock’s liquidity, with both foreign and Israeli investors believing that the stock exchange has further growth potential, and that management will skillfully manage the business, raise commissions, and maintain high profitability. The exchange is also developing new revenue streams, such as selling trade data, in addition to charging commissions.

In 2023, the stock exchange posted an 8% rise in revenues compared to the previous year, reaching NIS 390 million, and a net profit of NIS 83.2 million, a 64% jump, marking its highest profit since the IPO. Despite fewer stock offerings and reduced trading volumes due to the war and economic crisis, the stock exchange benefited from increased trading in other products, such as government bonds and mutual funds, as well as higher commission rates and linking fees to inflation.

In the first half of 2024, the exchange’s revenues grew by 11% compared to the same period in 2023, reaching NIS 213 million, driven by increased revenues from information distribution and connectivity services, as well as tariff increases. Net profit grew by a similar rate, reaching NIS 50 million.

Alon Sanovsky, head of Israeli equities at Migdal Insurance, told Calcalist, "It's clear that the stock exchange's management is proactive. They’ve focused on improving operations, finding new revenue sources, and strengthening relationships with the market." Sanovsky highlighted the sale of bank shares and Bill Ackman’s investment in the stock exchange as important milestones: "Ackman’s involvement is a vote of confidence that encourages both foreign and Israeli investors to believe in the stock exchange. Initially, the market compared the exchange to bank stocks and other financial entities, but it is different. Unlike banks, it has proven that market volatility is actually beneficial for it. When stock turnover declined, the exchange saw increases in other areas, such as bond trading. Furthermore, it has diversified its revenue streams, with trading commissions now just one component."

Indeed, the breakdown of the stock exchange’s revenue for the first half of 2024 confirms Sanovsky’s view. Trading commissions, totaling NIS 82 million, were the largest source of revenue, yet accounted for only 38% of the total. The exchange also generated significant revenue from registration fees, clearing services, and information distribution, each contributing around 20%.

Sanovsky believes that part of the stock exchange’s increased value stems from investors’ perception of its future growth potential: "If the stock exchange manages to grow revenue and profitability during a war, further growth can be expected once the conflict ends. The exchange is also working to attract foreign investors by changing its trading days. As long as the war continues, foreign investors may hesitate, but this change could make the local stock exchange a more attractive arena for them afterward."