AI’s power struggle: OpenAI, Meta, and Apple take on Nvidia’s chip empire

The world’s top AI players are no longer willing to rely on Nvidia’s expensive processors.

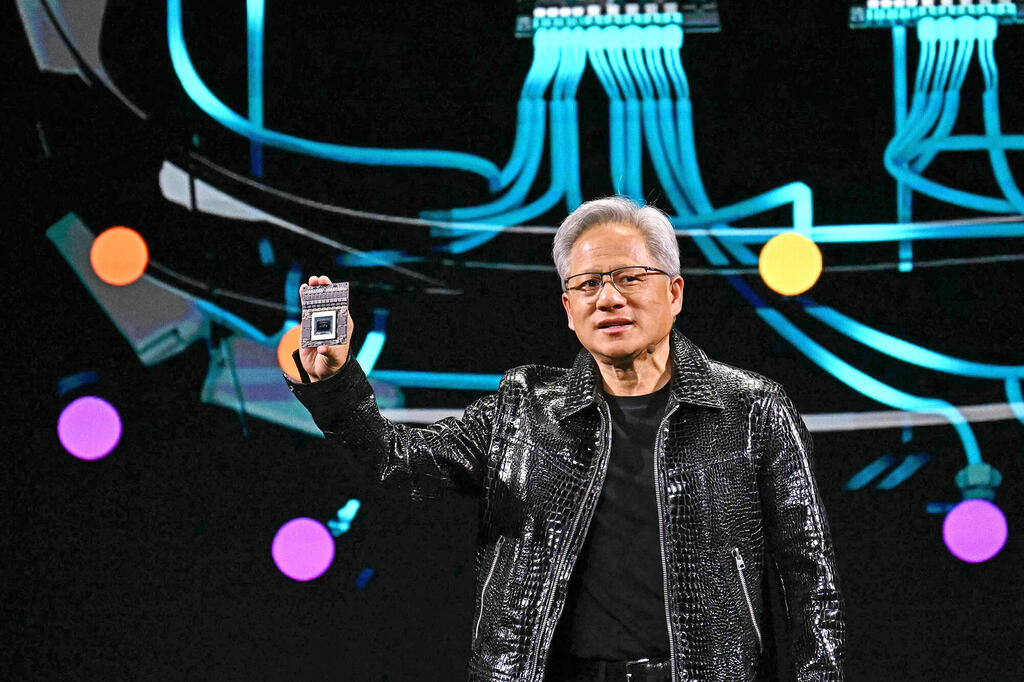

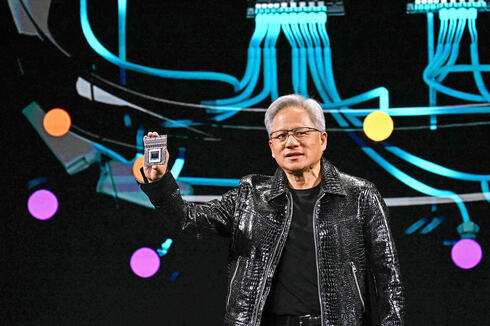

If there’s one company that dominates the artificial intelligence (AI) market, it’s undoubtedly Nvidia. Almost every major player in the field relies on its AI processors to train and run models. But the industry’s biggest players are not thrilled about this reliance. Nvidia’s dominance means high prices and a limited supply of the computing power needed to train and run next-generation AI models.

Now, as the DeepSeek moment forces the AI industry to reconsider long-held assumptions, OpenAI, Meta, Apple, Microsoft, Google, and Amazon are accelerating efforts to gain greater control over their chip supply and challenge Nvidia’s dominance.

OpenAI, the company most closely associated with the GenAI revolution, is also one of Nvidia’s largest customers. In January, the company—alongside SoftBank and Oracle and under the auspices of former U.S. President Donald Trump—launched Project Stargate, an ambitious half-trillion-dollar initiative to establish a vast AI computing infrastructure in the United States. And if CEO Sam Altman gets his way, very little of that money will go to Nvidia.

According to Reuters, OpenAI is developing its own AI chip to reduce its dependence on Nvidia. Sources indicate that the company is in the advanced design stages and expects to finalize the design within months. The next step will be transferring the design to Taiwanese chipmaker TSMC for experimental production and testing.

Experimental production costs tens of millions of dollars and typically takes around six months, though OpenAI could opt for an accelerated timeline. The company aims to begin mass production of its AI chip in 2026. While the first chip will primarily be used for running models rather than training them, OpenAI intends to develop more advanced processors over time. According to sources, this effort is not just about independence—it’s a strategic move to strengthen OpenAI’s negotiating position with Nvidia and other chip suppliers.

The DeepSeek moment that shook the AI industry in January has led to a reassessment of fundamental assumptions about AI model development. DeepSeek’s R1 model, which the company claims was built at a fraction of the cost of comparable models from OpenAI and Google, has prompted many to question whether massive computing power is truly essential for next-generation AI. If less power is needed, Nvidia’s expensive chips might no longer be indispensable. OpenAI’s chip development efforts predate DeepSky’s revelations, but the shift in thinking has reinforced their importance. To succeed, OpenAI’s chip doesn’t need to match Nvidia’s—it just needs to be good enough.

OpenAI isn’t alone in this pursuit. According to Forbes, Meta is in talks to acquire South Korean AI chip startup FuriosaAI, aiming to develop its own alternative to Nvidia’s chips. The deal could be finalized as early as this month. Last April, Meta unveiled a new generation of AI chips called MTIA (Meta Training and Inference Accelerator), primarily designed for traditional AI workloads such as recommendation algorithms. However, the company’s growing investment in chip development signals a broader ambition to reduce reliance on Nvidia.

Microsoft is also developing a series of AI chips to enhance model performance and support its AI data centers. Amazon is building an ecosystem of AI chips for its extensive cloud infrastructure, unveiling Trainium3 in December—the latest generation of its AI training and execution chip, based on technology from Israeli startup Annapurna, which Amazon acquired in 2015 for $370 million. Trainium3 is set to launch this year.

Meanwhile, Google is integrating AI models into its chip design process, led by its DeepMind division, to accelerate development. Apple is also expanding its AI chip efforts under its top Israeli executive, Johny Srouji. In December, it was revealed that Apple’s Israeli team—responsible for designing the company’s Mac chips—has been tasked with developing its first AI server chip. The project, a collaboration with chip giant Broadcom, is set for mass production in 2026 using TSMC’s most advanced manufacturing technologies.

As of today, Nvidia controls about 80% of the global AI chip market. It remains unclear which of these tech giants will succeed in breaking its grip. But with so many companies investing billions in AI chip development, it’s reasonable to assume that at least some will produce viable alternatives. And coupled with the paradigm shift sparked by DeepSeek, Nvidia’s dominance is likely to be challenged in the near future.