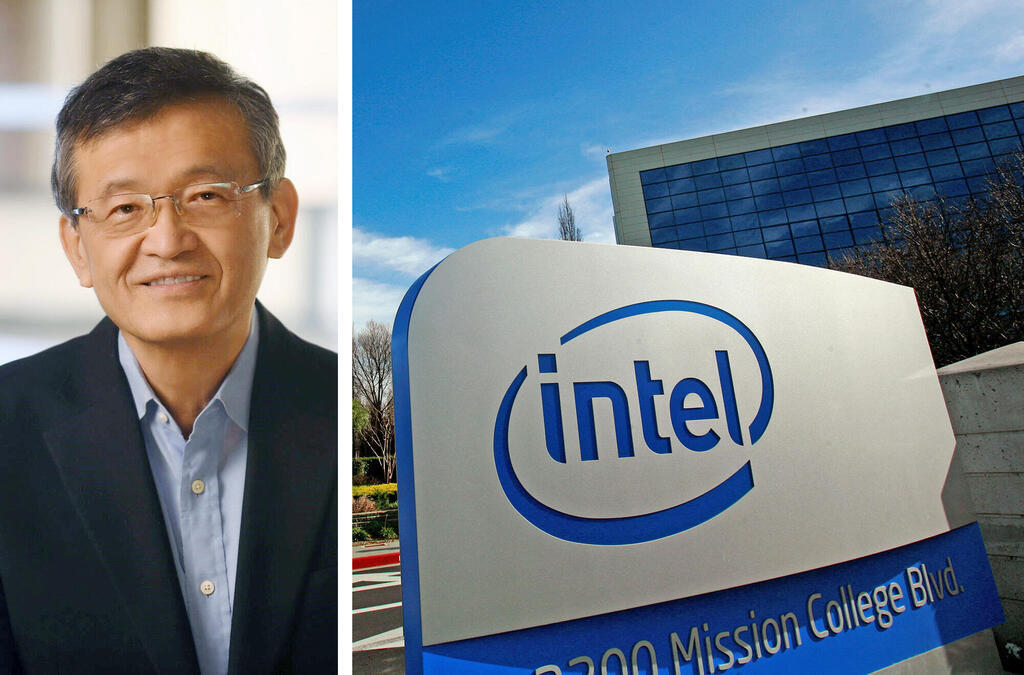

Intel's new CEO warns ‘hard decisions’ are ahead—are more layoffs coming?

Lip-Bu Tan’s first address to employees hints at further cost-cutting as Intel struggles to regain its footing.

Intel’s decision to appoint semiconductor industry veteran Lip-Bu Tan as CEO marks a turning point for the once-dominant chipmaker, which has been struggling to regain its footing amid intensifying competition and internal turmoil. While Tan’s arrival has been met with optimism on Wall Street, employees are bracing for more upheaval. The key question hanging over his tenure is whether he will be the leader who revives Intel—or the one who presides over its dismantling.

In his first address to employees, Tan spoke of building a "new Intel," but his message offered little in the way of specifics. He emphasized a focus on customers and shareholders, while warning that “hard decisions” lie ahead. Given his track record, many expect those hard decisions to include further job cuts.

Tan’s background suggests he will take a ruthless approach to cost-cutting. While he is best known for leading Cadence Design Systems, where he stabilized and grew the company, he has also been a venture capitalist with a sharp eye for efficiency. His frustration with Intel’s bloated workforce was well documented during his tenure on the board. Under Gelsinger, Intel’s headcount swelled by at least 20,000 employees, only for the company to later announce layoffs affecting over 15% of its workforce. Insiders say Tan believed those reductions were not enough.

Intel’s workforce remains significantly larger than its leaner, more agile competitors, leading some investors to question whether it is still burdened by layers of bureaucracy that stifle innovation.

Intel’s challenges are immense. The company, which defined the semiconductor industry for decades, has been outmaneuvered in artificial intelligence (AI) chips by Nvidia, outpaced in advanced semiconductor manufacturing by Taiwan’s TSMC, and undermined by years of internal inefficiency. Tan, who previously served on Intel’s board but stepped down last year amid frustrations with the company’s sluggish response to these challenges, now takes the helm at a moment of crisis.

His appointment follows the abrupt departure of former CEO Pat Gelsinger, whose ambitious plan to transform Intel into a world-class chip foundry—manufacturing processors for other companies in addition to its own—has yet to deliver meaningful results. Tan’s leadership will determine whether Intel doubles down on that strategy or pivots to a more drastic course of action.

A Breakup on the Horizon?

One of the biggest strategic decisions Tan faces is whether to keep Intel intact. The company’s dual identity as both a chip designer and a chip manufacturer has long been a point of contention. While Gelsinger’s foundry strategy was meant to turn Intel into a formidable competitor to TSMC, it has struggled to secure major customers. Reports suggest that TSMC has even approached companies like Nvidia and AMD about forming a joint venture to take over Intel’s foundry business—an idea that, if realized, would fundamentally reshape the company.

Tan’s decision to stay the course with the foundry business—at least for now—does not mean he won’t take drastic steps elsewhere. The idea of a leaner, more focused Intel, potentially shedding non-core operations, remains a real possibility. Some analysts speculate that breaking up the company—separating the design and manufacturing arms—could be the best way to unlock shareholder value.

The AI Revolution: Intel’s Missed Opportunity

Intel’s failure to capitalize on the AI boom remains a glaring weakness. While Nvidia has surged to the top of the semiconductor industry by dominating AI chip development, Intel has been largely left behind. The company’s missteps date back years, including passing up the chance to invest in OpenAI in 2018. Today, while Nvidia sells AI chips as fast as it can produce them, Intel is scrambling to remain relevant in the space.

If Tan is to turn Intel around, he must articulate a clear AI strategy—something Gelsinger struggled to do convincingly. The AI market is evolving rapidly, and companies that fail to secure a foothold risk becoming obsolete. Whether Intel’s future lies in AI chip development, foundry services, or both, Tan will need to act decisively to prevent further erosion of the company’s position.

A Leader with Limited Time

Investors have so far reacted positively to Tan’s appointment, with Intel’s stock jumping on the news. But the goodwill may be short-lived if he fails to deliver quick and visible progress. The semiconductor industry is brutally competitive, and Intel’s rivals are not standing still.

The reality is that Tan has little time to prove his approach will work. If his tenure is marked by more rounds of layoffs and cost-cutting without a compelling growth strategy, Intel’s decline could accelerate. If he cannot convince customers, employees, and investors that Intel has a clear and viable path forward, he may find himself overseeing not a turnaround, but an orderly dismantling of one of America’s most storied tech companies.

For now, all eyes are on Lip-Bu Tan. Will he be remembered as the leader who restored Intel’s greatness—or the one who presided over its final chapter?