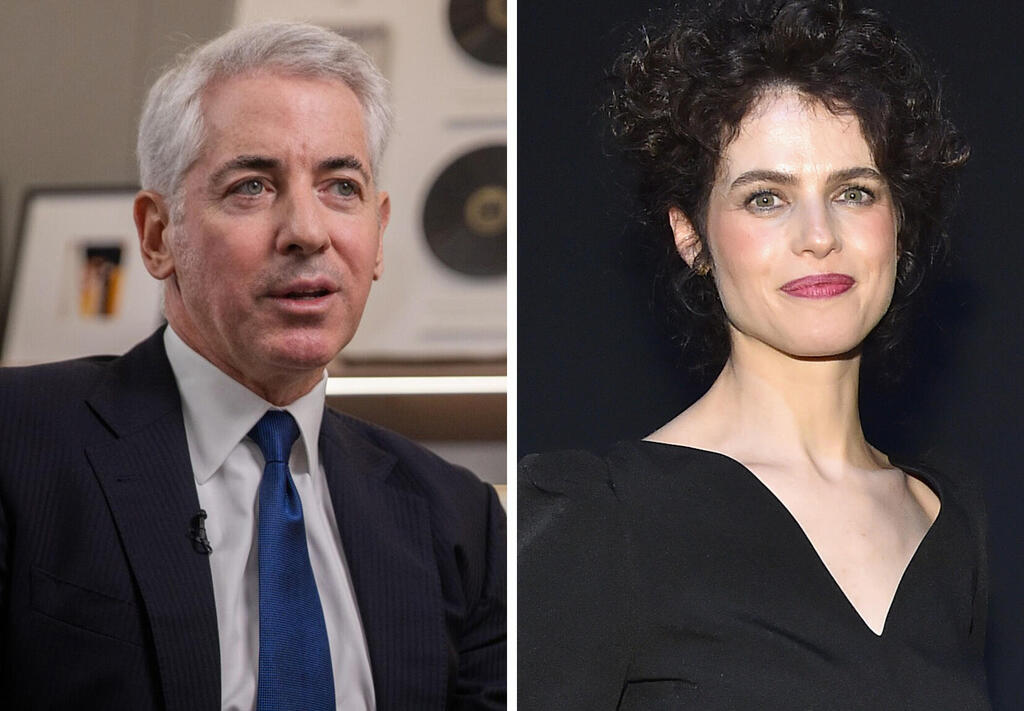

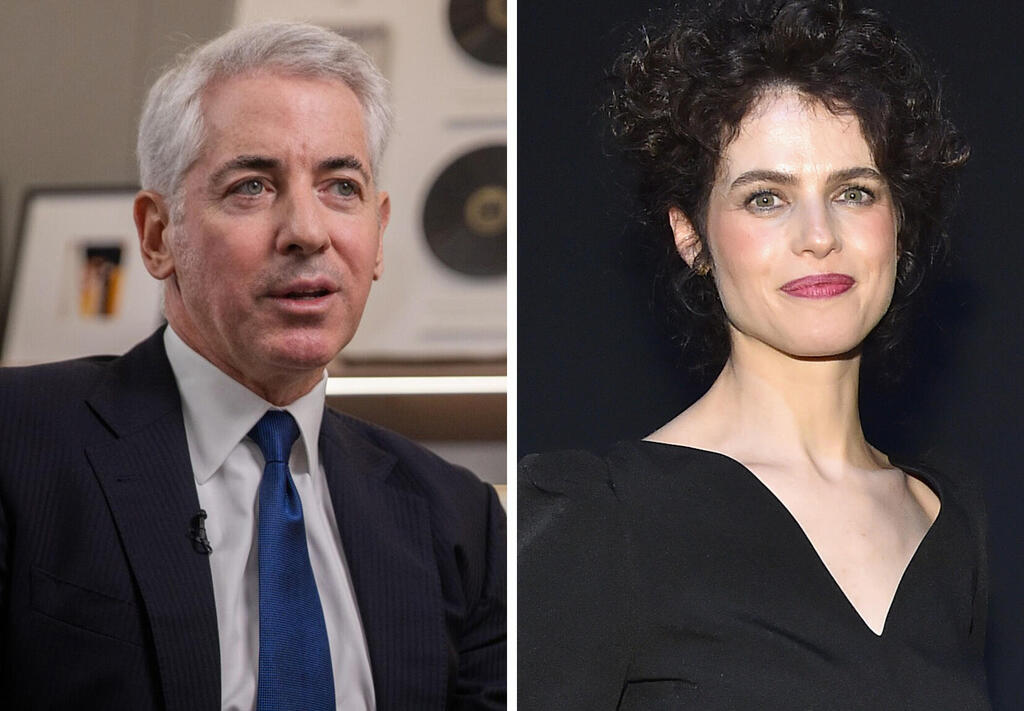

Bill Ackman and wife Neri Oxman buy 5% of Tel Aviv Stock Exchange for $17 million

The Jewish billionaire and his Israeli wife are making their first investment in Israel since the outbreak of the war with Hamas

Jewish billionaire Bill Ackman and his Israeli wife Neri Oxman have bought over 4.9% of the Tel Aviv stock exchange for around $17 million. This is Ackman’s first major investment in the country since Hamas attacked Israel on October 7 and the war in Gaza erupted.

The Tel Aviv Stock Exchange said it sold an 18.5% stake in total to a group of foreign and local investors for 242 million shekels (approximately $64 million). Ackman and Oxman were the only ones it named. The shares were previously held by Israeli banks Bank Hapoalim, Mizrahi Tefahot, and the First International Bank of Israel.

1 View gallery

Bill Ackman and Neri Oxman.

(Photo: Jacopo Raule/Getty images, Jeenah Moon/Bloomberg)

The majority of the proceeds will be directed to the stock exchange treasury and be used for investments in its technology infrastructure. The sale was executed within the framework of an agreement reached about a month ago between the banks and the stock exchange, which includes the distribution of a special dividend.

The transaction, the TASE said, drew interest from investors across Israel, the United States, Europe, and Australia, "reflecting a strong vote of confidence in both the Tel Aviv Stock Exchange and the Israeli economy at large."

The distribution of shares was facilitated by the investment banks Jefferies and Leader Capital Markets. Ittai Ben Zeev, the CEO of the stock exchange, mandated the sale of the banks' shares, citing a conflict of interest under securities laws due to the extended duration of their holdings.

In accordance with the 2017 stock exchange privatization outline, the banks were obligated to sell their shares at a fixed price of NIS 5.08 per share. Despite their initial refusal, citing the stock's current fourfold increase, a compromise was reached wherein the shares were sold at the agreed-upon price, accompanied by a simultaneous distribution of a NIS 231 million dividend.

Since April 2021, the stock exchange has witnessed a modest 10% increase in its value following an impressive initial surge in its first year of issuance.

Ackman has made plenty of headlines away from the investment world over recent months, including playing a significant role in the removal of the president of Harvard due to her inaction in regard to anti-Semitism on campus. For weeks, Ackman, the founder and CEO of the Pershing Square hedge fund, used his platform on X to attack Claudine Gay. This unfolded amid accusations that she copied materials from other academics and did not take a strong enough stance against anti-Semitism.

The latest chapter in Ackman's quest against U.S. higher education institutions came earlier this month and saw his wife cast in a surprising role. Allegations of plagiarism surfaced regarding Oxman's MIT doctoral thesis, this, on the back of Ackman's active role in calling for the resignation of presidents of Ivy League schools who were widely criticized for their congressional testimony about antisemitism on campus.