IL Tech in NY

Evolution Equity Partners: “Israeli startups bring a unique advantage to New York”

The VC joined CTech for its IL Tech in NY series in collaboration with Israeli Mapped in NY ahead of Calcalist’s Mind The Tech conference in New York in March.

“Compared to the Israeli market, New York offers greater market size, higher budgets for cybersecurity solutions, and exposure to global enterprises,” said Evolution Equity Partners. “However, Israeli startups bring a unique advantage to New York: their ability to innovate rapidly, solve complex problems with agility, and apply military-grade security expertise to commercial applications.”

VC Evolution Equity Partners joined CTech as part of the ongoing IL Tech in NY project in collaboration with Israeli Mapped in NY to shine a spotlight on the Israeli ecosystem in New York. At the end of March, Calcalist and CTech will host their annual Mind The Tech NY conference, bringing together the top Israeli and American high-tech industry Investors, managers, and entrepreneurs.

You can learn more about the firm below.

Fund ID

Name and type of VC: Evolution Equity Partners - Cybersecurity-focused Venture Capital Fund.

Main fields of investment: Cybersecurity and adjacent categories.

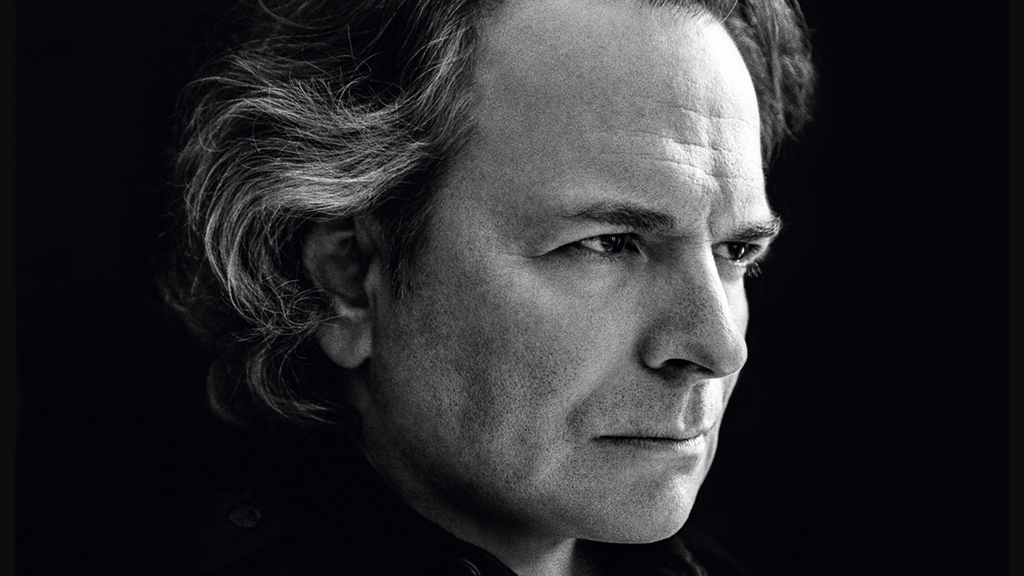

Names of managing partners: Richard Seewald and Dennis Smith.

Partners and/or other backers: A global network of institutional investors, corporate partners, and high-net-worth individuals.

Year of founding/start of NY operations: Founded in 2014; New York operations began soon after.

Total sum of investments/size, number of funds: $1.1 billion raised in the most recent fund, marking it as the largest dedicated cybersecurity fund globally, with over $2.5 billion of assets under management.

Median investment amount/Average investment in startups: $10M–$150M per company, typically in Series A and Series B rounds.

Number/size of rounds led: Evolution Equity has led 70+ funding rounds across multiple stages.

General background on the organization, its managers, its founders, and partners:

Evolution Equity Partners is a global venture capital firm founded by Richard Seewald and Dennis Smith with offices in New York, London, Palo Alto, and Zurich. The firm specializes in cybersecurity and enterprise software, investing in companies that protect our digital world. The team comprises seasoned investors, technologists, and entrepreneurs with extensive expertise in scaling global companies.

The founding partners of Evolution Equity Partners began their journey as operators and senior executives at AVG Technologies, a leading endpoint security company. From 1999 to 2012, they played a pivotal role in growing AVG from a startup into a global enterprise with multi-billion-dollar revenue, culminating in its IPO on NASDAQ in 2012. This success is widely recognized as one of the most significant software exits from Europe.

Building on their deep operational expertise and strong working relationships, the founders established Evolution Equity Partners with a mission to support cybersecurity companies beyond capital infusion. Over the past two decades, they have refined and institutionalized a proven playbook for scaling growth-stage businesses, leveraging their commercial experience and industry insights to empower their portfolio companies to achieve global success.

The Vision:

Evolution Equity Partners' vision is rooted in the belief that cybersecurity is not just a technology category but a critical enabler of trust and innovation in the digital age. As our society becomes increasingly interconnected, defending the foundational software layer or underbelly of our society that supports businesses, governments, and communities has never been more essential. This mission is more important than ever as the complexity of cyber threats continues to grow.

"Our team has had a front-row seat in the development of the cybersecurity industry over the past 30 years. First as investors and executives at AVG Technologies, and now as leaders at Evolution Equity Partners, we’ve contributed significantly to the industry's growth and maturity," Seewald said. "We’re committed to leveraging our experience to support the next generation of cybersecurity leaders."

By investing across stages, we ensure long-term growth while identifying and supporting transformative ideas early. This vision allows us to remain a leader in a category that is fundamental to the integrity of global markets and societies.

What types of Israeli startups/entrepreneurs are you interested in?

At Evolution Equity Partners, we are most excited about Israeli startups pushing the boundaries of cybersecurity, enterprise AI, and automation. Israel’s vibrant tech ecosystem aligns seamlessly with our thesis, offering a wealth of opportunities to invest in high-growth companies addressing large markets. We prioritize founders with innovative solutions, particularly those integrating machine learning and artificial intelligence to drive unique advancements.

We value entrepreneurs with a proven track record of success and a chip on their shoulders to tackle complex challenges. Evolution partners with entrepreneurs who have a clear vision for global scalability, creating solutions that address international markets. Israeli startups often stand out due to their strong technical leadership, with founders who combine deep technical expertise with a profound understanding of market needs. These qualities make Israel a critical hub for identifying transformative cybersecurity innovations.

Why invest in an Israeli company in New York? What advantages do such companies have? How is the New York market different from the Israeli market?

Investing in Israeli companies that establish a presence in New York presents a compelling opportunity. Many Israeli startups view New York as a strategic entry point into the U.S. market, providing access to a vast and diverse customer base. New York is a global financial and technology hub, enabling Israeli companies to connect with major enterprises, investors, and strategic partners. This environment accelerates their growth by offering unparalleled networking opportunities and direct access to decision-makers.

Compared to the Israeli market, New York offers greater market size, higher budgets for cybersecurity solutions, and exposure to global enterprises. However, Israeli startups bring a unique advantage to New York: their ability to innovate rapidly, solve complex problems with agility, and apply military-grade security expertise to commercial applications. These strengths enable Israeli companies to compete effectively and stand out in the highly competitive New York market.

How do Israeli entrepreneurs/startups differ from their local counterparts?

Israeli entrepreneurs are known for their resilience, creativity, and problem-solving skills, shaped by their experiences in the military, particularly within elite technological units. This background fosters a culture of innovation and rapid adaptation to challenges. They often approach problems with a global perspective, building products that address international market needs from day one. Compared to their local counterparts in other markets, Israeli startups tend to move faster, iterate more efficiently, and focus intensely on technical excellence. Their ability to pivot and find solutions in high-pressure situations is a key differentiator.

How do you assess the risk involved in investing in Israeli companies in the current situation?

Investing in Israeli companies comes with a unique set of risks, particularly given the political and security landscape. However, the cybersecurity sector often proves resilient to external shocks due to its critical nature and consistent global demand. At Evolution Equity Partners, we mitigate risk by partnering with founders who demonstrate a deep understanding of the challenges they face and by ensuring our investments have strong governance and operational frameworks in place. Furthermore, the global applicability of Israeli cybersecurity solutions allows these companies to diversify geographically, reducing reliance on any single market. While risks exist, the potential rewards and innovation coming out of Israel often outweigh these concerns.

Action points for Israeli entrepreneurs in New York:

Success will be driven by leveraging New York’s extensive network of investors, enterprise clients, practitioners, and strategic partners to accelerate growth. Develop a strong local presence and tailor your messaging to resonate with the U.S. market while showcasing your unique Israeli innovation.

Avoid underestimating the cultural and business differences between the Israeli and U.S. markets—adapt your approach accordingly. Don’t focus solely on technology without emphasizing the business value and ROI for potential customers and investors.

Are there any legal or regulatory considerations that you take into account when investing in Israel? How do you deal with possible law/regulation changes in Israel?

When investing in Israel, we consider the regulatory environment carefully, ensuring compliance with both local laws and international standards. Our global presence and experience working across multiple jurisdictions give us the expertise needed to navigate any changes in Israeli regulations. We also maintain close relationships with local legal and financial advisors to stay informed about any potential shifts in the regulatory landscape. By taking a proactive approach and fostering open communication with our portfolio companies, we can adapt to changes and minimize potential impacts on our investments.

Are there global trends that influence your decisions to invest in Israeli high-tech?

Global trends such as the rise of AI, automation, and the growing sophistication of cyber threats heavily influence our investment strategy. The increasing reliance on digital infrastructure across industries and the persistent threat posed by nation-state actors and cybercriminals create an urgent need for innovative cybersecurity solutions. Israel’s position as a global leader in cybersecurity innovation makes it a natural choice for us to seek investment opportunities. Additionally, trends like the adoption of machine learning and AI in security operations, the rise of generative AI, and the focus on addressing human factors in cybersecurity are areas where Israeli companies are making significant strides.

We are in the midst of the AI revolution. Do Israeli companies have an advantage in this sector, or is there room for improvement?

Israeli companies hold a significant advantage in the AI revolution due to their strong technical foundations, robust R&D ecosystems, and ability to innovate rapidly. Many Israeli entrepreneurs leverage their military experience to develop advanced AI and machine learning solutions that address complex cybersecurity challenges. However, there is still room for improvement in areas such as commercialization and scaling AI-driven products for global markets. By combining their technical prowess with strategic partnerships and access to global markets, Israeli startups can solidify their leadership in this transformative sector.

Examples of successful investments:

Torq:

Torq, a next-generation leader in Security Orchestration and Automated Response (SOAR) technology, continues to revolutionize how organizations manage and respond to cybersecurity challenges. By leveraging a cloud-native, multi-tenant, zero-trust architecture, Torq’s platform empowers enterprises with hyper-automation capabilities through its no-code, low-code, and full-code graphical interface. This innovative approach enables seamless interoperability across security systems, allowing customers to automate repetitive workflows, streamline cybersecurity operations, and respond to incidents rapidly. Torq addresses critical challenges such as security tool sprawl, the cyber skills gap, and multi-cloud complexity, enabling security teams to focus on strategic priorities.

Torq’s success is underscored by its impressive growth, achieving 3X+ revenue and Fortune 500 customer expansion for the second consecutive year, and setting an ambitious $100M ARR target by 2026. Their flagship offerings, Torq HyperSOC and Torq Hyperautomation, have rapidly gained traction among global enterprises, solidifying their position as a market leader.

Evolution Equity Partners has been proud to support Torq throughout its journey, most recently leading the $70 million Series C round in September 2024 after participating in the $40 million Series B1 round in Q3 2023. We are deeply impressed by the team’s execution, vision, and ability to drive remarkable growth in such a dynamic space. As a firm, we are thrilled to continue partnering with Torq as they redefine security operations and lead the charge in hyper-automation.

Protect AI:

Protect AI is addressing a critical and growing need in the cybersecurity landscape by pioneering solutions that secure machine learning systems and AI applications against unique vulnerabilities and emerging threats. Founded in 2022 by former AWS and Oracle AI executives, Protect AI’s platform injects security throughout the entire ML development lifecycle (MLSecOps). Their comprehensive capabilities include an ML Bill of Materials, ML supply chain vulnerability scanning, security tests for AI/ML models, LLM prompt injection scans, and AI red team tools. These innovations ensure that organizations can proactively manage the security posture of their AI and ML systems, even as adversaries increasingly exploit these technologies to automate and enhance their attacks.

As machine learning and AI continue to reshape industries, the cybersecurity challenges they introduce have become more urgent. The rise of generative AI and large language models has expanded the attack surface, creating opportunities for cybercriminals and nation-state adversaries to launch more sophisticated, resource-efficient attacks. Protect AI’s mission to safeguard ML systems and AI applications comes at a pivotal moment, enabling organizations to defend against this next generation of threats effectively.

Evolution Equity Partners is proud to support Protect AI in its mission to redefine cybersecurity for AI and ML environments. After participating in their Series A round in 2023, Evolution led Protect AI’s $60 million Series B round in 2024, doubling down on our commitment to help organizations navigate the challenges posed by AI-driven threats. With a visionary team and the most comprehensive end-to-end MLSecOps platform, Protect AI is well-positioned to lead the charge in securing AI and ML technologies for the future.