Analysis

Harris vs. Trump: Competing visions for America's economic future

A contrast in policy proposals reveals divergent paths on taxation, spending, and social welfare that could reshape the nation.

Until a decade ago, elections in the United States focused on central economic issues. One memorable election slogan, "It's the economy, stupid," was coined by Bill Clinton's strategist. However, one of the characteristics of the 2024 campaign is a shallow, superficial, and cliché-laden economic discourse.

The most striking example is the claim that a Donald Trump victory is beneficial for the economy. The Committee for a Responsible Federal Budget (CRFB) analyzed the measures proposed by the two candidates and concluded that both would increase government debt, with Harris adding about $3.95 trillion by 2035, while Trump's economic plan would increase it by approximately $7.75 trillion.

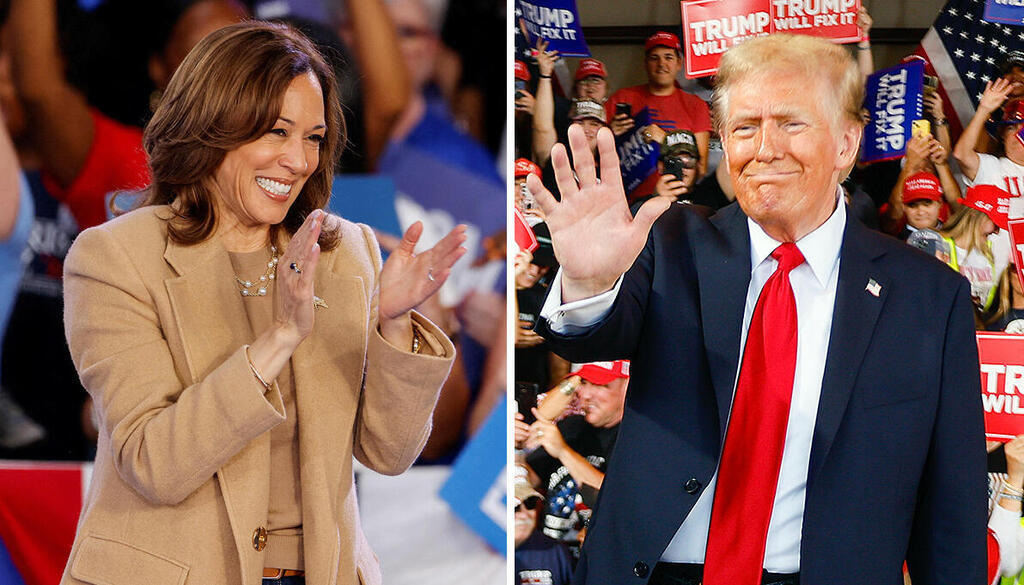

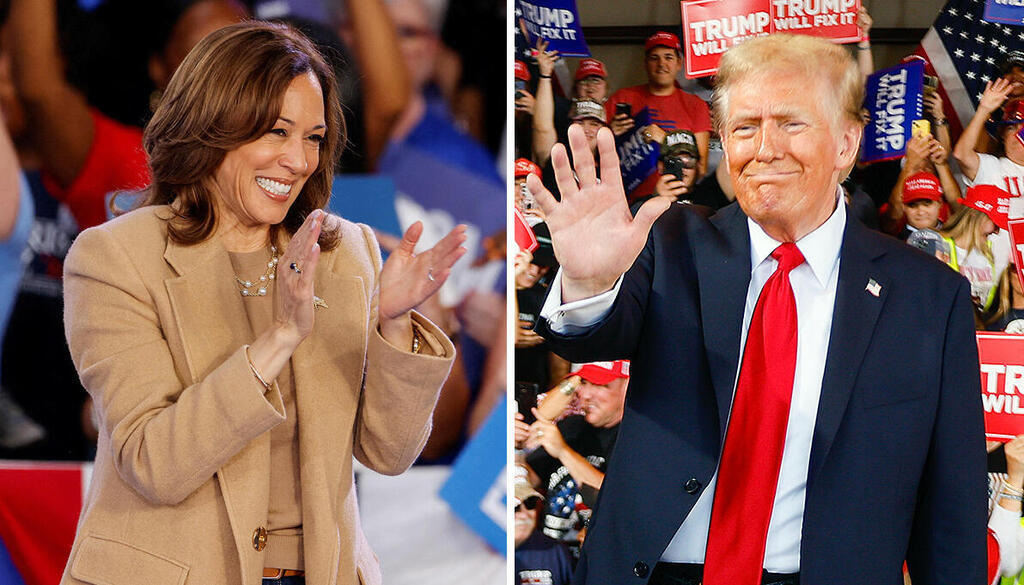

1 View gallery

Kamala Harris, Donald Trump

(Photos: Chip Somodevilla/Getty Images, REUTERS/Jonathan Drake)

Last weekend, the research department of the Institute of International Finance (IIF) published an analysis of the macroeconomic implications of both candidates, yielding similar results: Harris's policy is expected to increase the deficit by $1.4 trillion, while Trump's will increase it by $3 trillion. In the days leading up to the elections, economist Nouriel Roubini from New York University stated that Trump "does not deserve" the slight advantage he holds over Harris in matters related to the economy. According to him, Harris and Trump differ on "fiscal issues, trade issues, climate, immigration, and monetary policy," with Trump's policies expected to cause inflation, reduced growth (due to increased import tariffs, currency devaluation, and immigration restrictions), and a surge in the federal budget. Roubini also claims that, strangely, "the markets have not yet priced in the damage that Trump will inflict on the economy."

Trump will be good for the wealthy. A review of the main proposals from both candidates reveals that while Trump intends to reduce corporate taxes and boost tax benefits for the rich in combination with the reduction of import tariffs, Harris aims to increase funding for health and welfare programs and boost child benefits, financing this through raising corporate taxes. Thus, Trump’s policy is expected to be, on paper, more inflationary, protectionist, and anti-egalitarian—one of the most challenging issues facing the United States and a key factor contributing to its descent into populism, as evidenced in the current election campaign.

The perception that Trump is good for the economy largely stems from the fact that during his presidency, the S&P 500 index surged by 67%, even amidst the worst pandemic in over a century. However, it is important to remember that this stock market boom was fueled by unprecedented expansionary monetary and fiscal policies: government debt increased by $7.8 trillion, marking one of the sharpest increases in single-mandate debt in U.S. history, both in absolute and percentage terms (a jump of about 40%). During Trump's presidency, the interest rate dropped from 2.5% to 0% to support the economy during the pandemic. Inequality also rose across nearly every measure: the Gini index increased, the poverty rate rose (making the U.S. the poorest country in the West in 2021), and the share of GDP held by the top decile increased from 28.5% to 29.5%, with the wealth of the top quintile (the top two deciles) being 8.6 times greater than that of the bottom quintile—second only to Chile in the OECD and compared to an average of 5.3.

Geopolitical risks have also been overlooked. The shallow discourse has prevented essential questions from being raised, especially regarding someone who has served for four years as vice president. In an interview with Professor Niall Ferguson, one of our generation's most important thinkers, he emphasized that the Biden-Harris administration has consistently struggled with deterrence issues: in Afghanistan (the return of the Taliban), in Eastern Europe (Russia's invasion of Ukraine), and in the Middle East (Iran's proxies attacking Israel). These issues are critical, as highlighted by the IIF's analysis and the economists at the International Monetary Fund, which indicates that geopolitical risks pose a significant threat to the global economy.

These concerns gain added urgency in light of estimates from American intelligence agencies and other international bodies that predict China may attack Taiwan around 2027. Ferguson remarked, "Trump's little finger has more deterrent power than the entire Harris cabinet." Supporters of Harris as a capable candidate for leading the world's largest power through its most dangerous challenges must also consider that she is backed by extreme left-wing figures such as Democratic Representative Alexandria Ocasio-Cortez.

The 2024 election serves as evidence that the United States has also fallen into the trap of populism, characterized by the polarization of political discourse, portraying opponents as agents of chaos, eroding trust in democratic institutions, and personal attacks fueled by simplistic narratives. All of these factors contribute to the normalization of extremism, hatred, and social polarization.