Interview

Definitively fintech: “Fintech is the driver for everything we can think about”

In an in-depth interview, Ronen Assia, Managing Partner at venture group Team8 and co-founder of social investing platform eToro, talks fintech, the future - and even farming

“I’m a big fintech evangelist,” Ronen Assia, Managing Partner at venture group Team8 and co-founder of social investing platform eToro proudly stated in an interview with CTech on the state of fintech in Israel. “I’ve been in the field for 16 years and am a big believer that fintech is only going to get stronger since money is at the epicenter of everything that we do. In a capitalist society fintech is the driver for basically everything we can think about.”

Israel is home to some of the world's most famous unicorns and nearly one in every five is estimated to be fintech-related. Why is that?

“First of all, I think Israelis love challenging problems and fintech is a very challenging domain. If you think about the growth of Israeli tech in general that started from very deep enterprise software and you think of the challenges of fintech, they are quite similar. How do you create great infrastructure for a whole domain? How do you tackle challenges within very large organizations? Selling to a Fortune 500 company is no different than integrating with a big bank. So, I do believe that we as Israelis like to tackle big, audacious challenges - and not just create more ‘fun’ lightweight applications.

“The second thing is that when we look at innovation globally and think about of all the big players who came to Israel to set up shop here, that breeds a whole new generation of entrepreneurs that learned and fell in love with the fintech domain and that in turn creates more opportunities for more companies to spin out from that - a whole fintech ecosystem that’s built up in Israel over the years.”

Assia cited the example of PayPal which entered the Israeli market after making an acquisition of Israeli startup Fraud Sciences in 2008. According to Assia, after the acquisition, PayPal had some 150 people working for the company in Israel, but since then PayPal’s Israel branch has become one of the company’s biggest in the world. “The knowledge and experience acquired by the large numbers of PayPal employees in Israel as the local branch has grown feeds back into the Israeli ecosystem which is very important,” Assia explained. “It’s not just about cultivating from within, but external companies setting up shop in Israel.”

As far as raising the next generation of fintech entrepreneurs, it has to start early, correct?

“It definitely has to start early. Think about organizations such as the IDF intelligence units (including 8200), which paved the way for all the cyber innovation. There are a lot of departments within the IDF that also deal with how money moves globally. This also leads to more innovation. It’s not just about Israel being a cybersecurity empire, but looking at other domains like telco, fintech, and all kinds of enterprise software. That’s also where a lot of innovation comes from.”

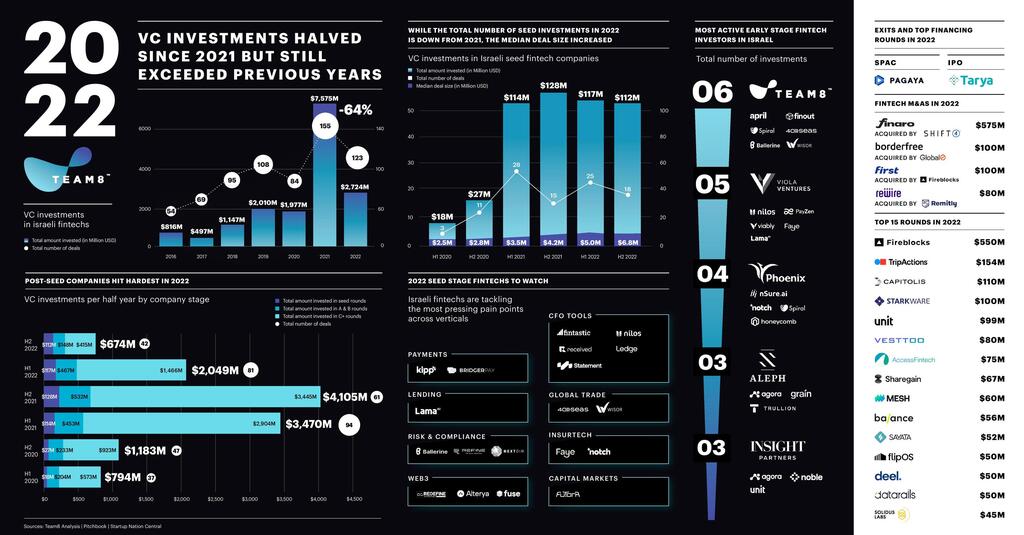

Fintech: Behind the numbers

According to Team8, while the overall investment in Israeli fintech decreased between 2021 and 2022, the volume of investments made during the last 12 months still exceeds the records of the previous years, reaching $2.72 billion spread over 123 transactions. In addition, the average deal volume in 2022 was approximately $22 million, not far from the average of 2020 which was $23.5 million. However, the amount invested in A and B rounds decreased by 38% between 2021 and 2022, while investments in C+ rounds decreased by 70%. According to Team8’s data, Seed-stage companies have attracted relative interest from investors over the past two years and have maintained a stable range of $112-128 million in investments in the first half of 2021-2022.

Take us behind these numbers. What do they reflect?

“Generally, over the last couple of months it seems like everyone was slightly pessimistic, but if you look at the actual numbers, I think everyone quietly agrees that 2021 was an outlier, a year of hyper-growth and “cheap” money. So, if you remove 2021 the charts obviously look much better. If you look at the net numbers we are still on a good trajectory. However, if you dive a bit deeper you will discover that there is more of an appetite in the market to engage in early stage investments than late stage investments and that’s because growth companies have to adjust to the current macro environment. But overall investors still believe that there will be more innovation and more companies that will emerge, and we see it specifically in the seed investment trend. The appetite and interest is still there.”

The farmer analogy

Can you provide an example?

“Perhaps an analogy will help. If you’re a farmer and you’ve suffered through a bad year in terms of weather, then you’re not only worried about your current crop, but you’re also concerned about what will be with your crops for the coming year. In our fintech world, the Seed-stage investment is in essence just like the farmer’s crop for the coming years. Since our findings show that the Seed-stage investments have not been impacted as other parts of the economy have, ,and the median investment size even increased, I think it’s safe to say that new companies will still get established and funded and we will see a full new roster - or crop - of potential unicorns growing out of the Israeli fintech industry for the next couple of years going forward. The important thing is that we are still planting the seeds.”

To what do you attribute Team8’s success in this area?

“Part of our ‘secret sauce’ is being able to work with talented entrepreneurs as early on as we can during the very initial ideation stage. We discuss with them what it is we want to create, what are the exciting opportunities in the market, what’s hot and what’s not, what’s moving the economy, etc. When we do that we are helping cultivate - or using the farming analogy ‘nurture’ or ‘grow’ - the next generation of entrepreneurs. We don’t just invest in companies that are already at a certain stage, we also work with founders at their earliest stages before they are ‘a company’. I believe that’s one way we play an important role in the Israeli ecosystem since we do our work so early on. It’s like with cherry tomatoes, the seeds are actually more precious than the actual final product, so we cultivate them.”

Due to the concerns of the pending judicial reforms, some leading companies, including a few in the fintech industry, have pulled their money out of Israel. How will this affect Israel’s fintech industry on the whole?

“To be honest, in my opinion, the issue of companies pulling their funds out of Israel is minor compared to what we should really be focusing on. The big ‘fear factor’ is if investors begin to pull out their money. What solely matters to foreign investors is the economic impact. They care about their economic returns. Therefore any act which is taken which may harm the Israeli economy needs to be done with extreme caution.”

Looking ahead to the future, can the ‘startup nation’ become the fintech nation’?

“In 2023 if you think about how our money is managed and moved and dispensed and with everything that’s going on with the macroclimate with interest rates it’s become more important than ever to continue and innovate in the field and I think we’ll continue to see more innovation, more companies being created in the space, and more unicorns coming out of Israel. So we’re definitely heading towards becoming a ‘fintech nation’.”