Analysis

The great AI gold rush: Are tech stocks riding a wave or heading for a crash?

Market dominance or risky speculation? Evaluating the technology sector's soaring stocks

To date, 2023 has been the year of technology stocks. Everyone is talking about artificial intelligence and the stocks of tech companies are taking off and opening a big gap compared to all other sectors. Is it a financial bubble that is developing before our eyes, or is it a natural development given the advancements in technology?

When you look at what is happening on Wall Street, the dominance of technology stocks is clear for all to see. The Nasdaq index, which is heavy on technology stocks, has jumped 27.5% since the beginning of the year, while the S&P 500 index, which includes the largest companies traded in the U.S. and is a more reliable reflection of the American economy, has climbed only 12%. The Russell 2000 index, which includes the smaller companies in the U.S., rose only 4.6% this year, and the Dow Jones index, which includes the more traditional companies, has climbed by a mere 1.9%.

In fact, it is the technology stocks that have pushed up the S&P 500. When you look at the return recorded by the main index in the U.S. with equal weighting—that is, when you neutralize the relative weight of the companies in the index and give all companies the same weight—then you can see that it has increased since the beginning of the year by 1.6%. In other words, the rise of the American economy that is reflected in the central index is actually the surge of technology stocks.

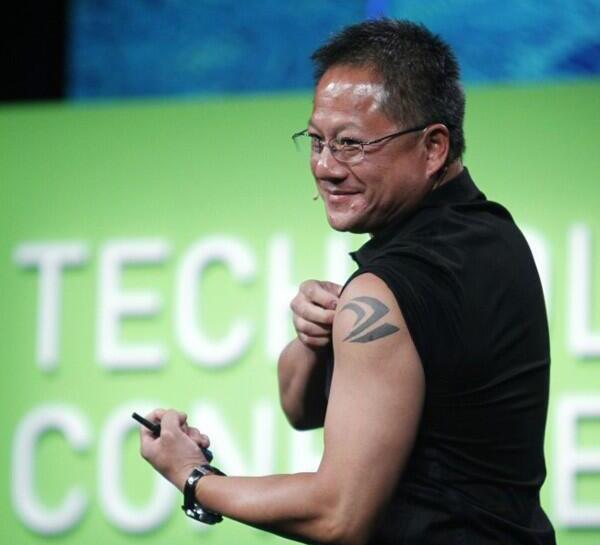

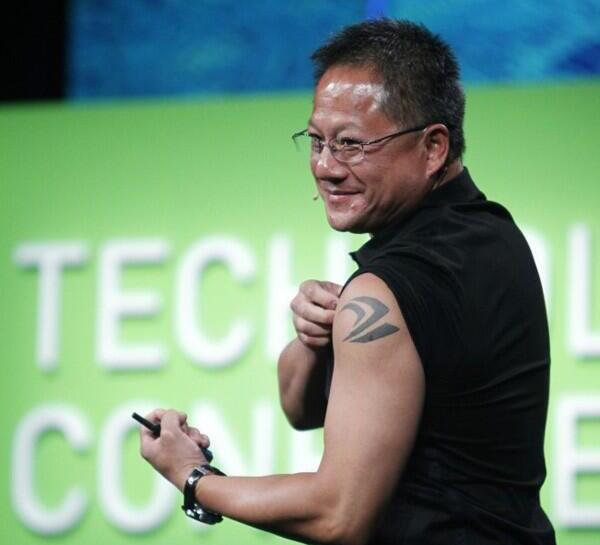

Indeed, according to Bank of America, the seven technology giants—Microsoft, Amazon, Alphabet (Google's parent company), Apple, Tesla, Meta, and Nvidia, which last week reached a trillion dollar market value for the first time—make up 28% of the S&P 500 in market capitalization terms. This is the highest level historically reached by this group of companies in this measurement method. A similar level was also recorded during 2022.

In fact, the market value of the seven technology giants is greater than the combined market value of all the companies in the S&P 500 index from the sectors of industry, finance and energy.

The tech giants have left everyone else in the dust. To illustrate, since the beginning of the year, Apple's stock has risen by over 40%, and the company's market value stands at around $2.8 trillion, while Microsoft's stock has fallen by 40%, and its market value has reached $2.5 trillion. The stock of Nvidia, the star of the year, has soared 175% since the beginning of this year.

Weekly record of investments

In line with the surge of big tech companies, and in a circular fashion, investors are flocking to technology stocks. Last week, $8.5 billion flowed into funds that specialize in investing in technology stocks. This is an all-time record in terms of deposits to these funds in one week, and in fact the money that flowed into these funds constitutes the majority of the money deposited in equity funds that week ($13.3 billion in the U.S. alone, $14.8 billion globally). This record of deposits stands out against the background of deposits to the funds that specialize in bonds, for example, which amounted to only $1.1 billion, even though it is a solid asset where a yield of 4-7% can currently be obtained.

But there are also warning signs. According to Bank of America, the ratio between the technology stocks that it calls monopolistic (that is, the large stocks that are included in the Nasdaq 100 index) and the small stocks in the U.S., which are concentrated in the Russell 2000 index, returned to its level on the eve of the dot.com crisis of the early 2000s. In March 2000, this ratio peaked, and shortly thereafter the bubble burst. Indeed, at the end of last month, Bank of America defined the influx into the engine that pushes technology stocks higher, artificial intelligence - a term that was mentioned in the conference calls on Wall Street this quarter more than 1,100 times - as a "mini-bubble".

At the same time, last Friday the fear index (VIX) ended trading at 14.6 points, after falling by 36% since the beginning of the year. This is a three-year low for the index that measures investors' concerns about sharp volatility in the markets. The decrease in the fear index expresses the investors' confidence in that the horizon looks bright, especially for the technology stocks, despite the fears of a recession, even a slight one, that may come. But to the same extent it may also teach about a certain indifference which means a lack of alertness to the dangers lurking around the corner.

Expanding the circle

Is it really a bubble? Opinions in the market are divided. On the one hand, the rally in technology stocks rests on two legs. The first - the sharp declines of the Nasdaq last year, in which it erased 33% of its value, which were followed by significant efficiency measures on the part of the big tech companies, which pushed them to rebound, which was followed by the artificial intelligence boom - the second and more significant leg of the current rally.

But on the other hand, this trend does excite investors a lot, but it is evident, in light of the performance of the shares, that they believe that the largest companies will be the ones who will be able to leverage this into a significant business activity. That is, that huge profits, if and when they come, will not be something many companies will experience.

Therefore, the main question is what will happen from here on. Artificial intelligence is seen in the market as a more significant business event than the metaverse, and one that carries tremendous economic value. At the moment, the big companies are the main beneficiaries of the trend, and it is possible that in the future more and more companies will benefit from it in a way that is sustainable. In such a situation, it is likely that the differences between the performance of the stocks will also be reduced. However, if artificial intelligence turns out to be a trend that has brought with it more hot air than actual economic value, it is likely that the big stars will be punished more significantly by investors.